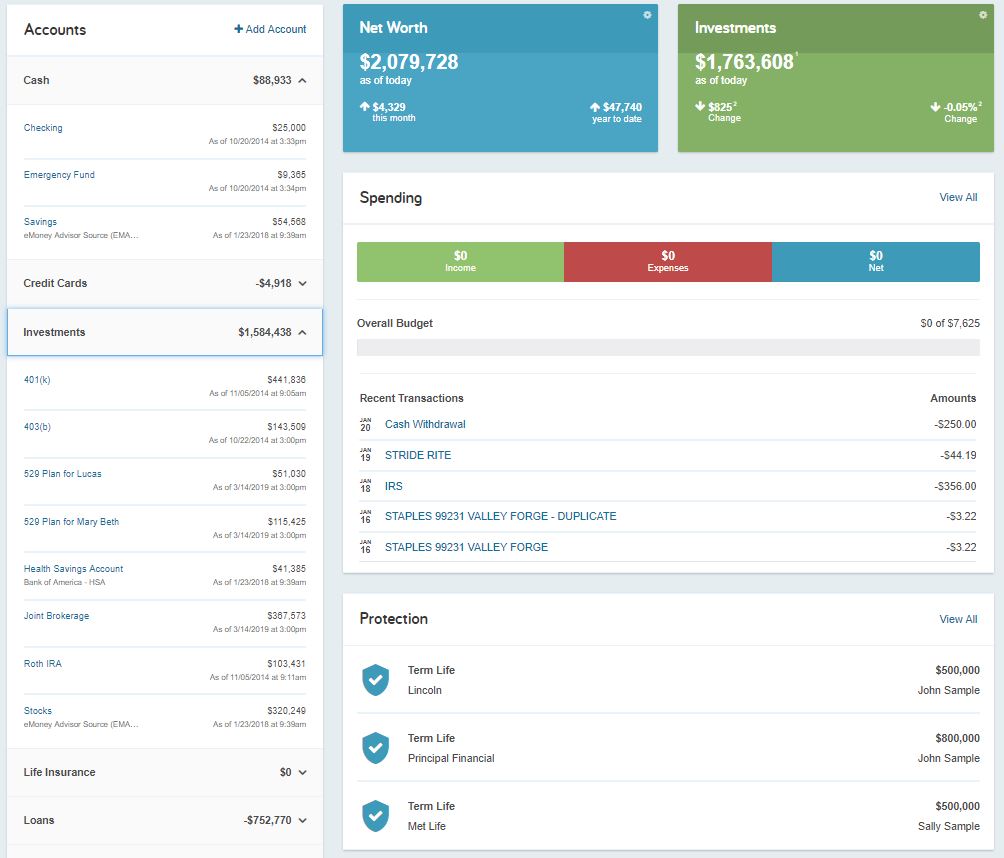

No sales pitch, just education

How much better would you feel about your financial situation if you had a better handle on the core concepts behind investing, budgeting, insurance, debt and taxes? You don’t need a PhD, but a 101 will make you more independent and more likely to succeed. We use illustrations and analogies to make complex concepts easier to grasp. If you are craving even more knowledge, we can take the education as far as you want. Our whiteboards are never clean.

Your advisor should be an advocate

When selecting a physician to work with, most people try to select someone that they can communicate with and trust. They want someone that can step into their shoes, assess their overall health and make recommendations that are in their best interests. Ultimately, they are looking for an advocate. When it comes to your finances, why would selecting an advisor be any different? It shouldn’t. We believe that our job is to help educate you, present you with options to help you achieve your objectives and then hold you accountable to taking action.

Accountability leads to progress

Have you ever made a New Year’s resolution, worked really hard for a few months and then scrapped the whole plan? Of course you have – we all have. It’s one of the reasons people hire a personal trainer to lose weight – accountability. We believe that once we’ve worked with you to develop a plan to reach your goals, both the advisor and client should be accountable to executing the strategy. If not, your financial plan may end up like so many treadmills that have been repurposed to hang clothes on. Accountability is the glue that helps you stay on track to achieve your most important financial objectives in life.

North Office

Austin Wealth Management

5209 Burnet Rd

Suite 210

Austin, TX 78756