Charity + Tax Deduction: a charitable fund

November 8, 2016 | By Kevin Smith, CFA

This may be relevant if you are interested in some combination of the following…

- You want to be involved in charitable giving.

- You are seeking tax deductions.

- You want to take your time to determine the proper array of charities you support.

- You want to manage your pool of donation dollars over the course of time.

- You want to establish an ongoing charitable fund for your family that will continue for generations.

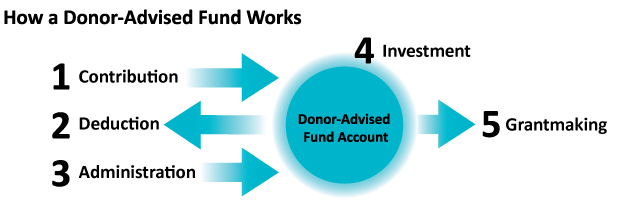

A donor advised fund (DAF) is a charitable investment account setup for the purpose of charitable giving. The money that goes into the account becomes an irrevocable transfer to a public charity with the specific intent of funding the charity.

Here is how it works:

1) You make an irrevocable contribution to the donor advised fund. ($5 or 10k minimum)

2) You receive the tax deduction allowed by the IRS in the year of the donation.

3) Name your account and any successors, or charitable beneficiaries.

4) An administrator places your funds in an investment account.

5) On your own timetable, you can recommend grants to qualified charities and nonprofit organizations.

References:

References:

Source of general description: https://www.aefonline.org/what-donor-advised-fund

Image source: https://www.nptrust.org/what-is-a-donor-advised-fund

Return to Blog Page