2018 Q3 Trends – Global stock market divergence

October 22, 2018 | By Kevin Smith, CFA

The difference between stock market returns from these broad regional categories have reached historical significance in 2018. As disciplined investors, we see an opportunity to buy stocks at historically attractive prices and remember that trends tend to reverse and the timing is always unpredictable.

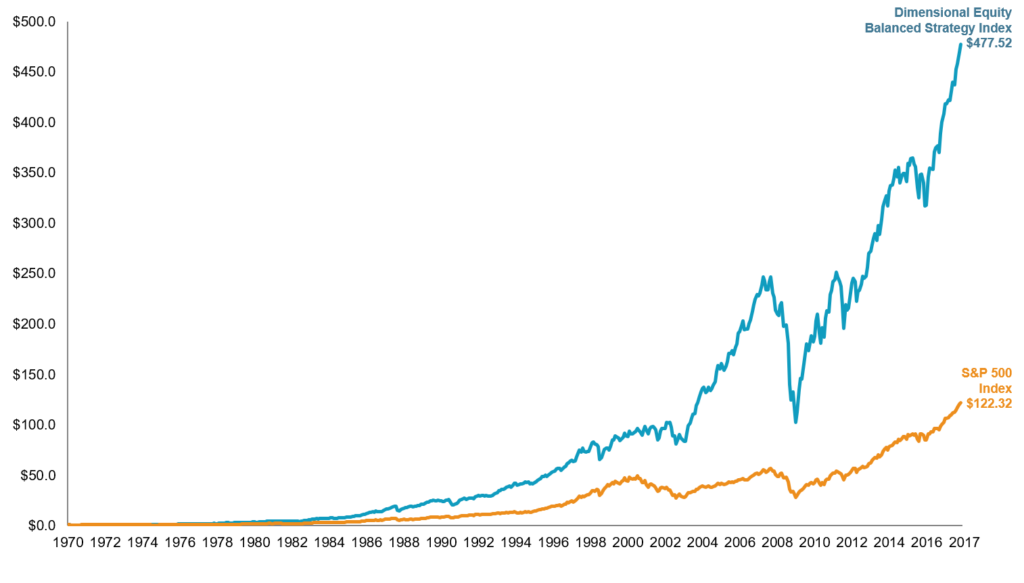

The global strategy, in combination with ‘value investing’ and ‘small cap investing’, has been kind to disciplined investors. The chart below shows the growth of $1 invested in 1970 in a global portfolio (blue) compared to investing only in the US S&P 500 (orange). The hypothetical global investor ended up with $477 compared to the S&P 500 investor’s $122.

Definition of the Balanced Strategy Index

70% US Stocks – large cap value, small cap, small cap value, Dow Jones REIT

30% Non-US Stocks – international value, international small cap and small cap value, emerging markets, and emerging markets value and small cap

Return to Blog Page