2018 Q3 Trends – Interest Rates Up

October 22, 2018 | By Kevin Smith, CFA

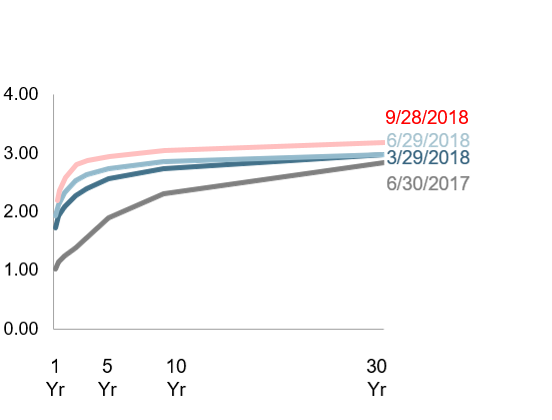

We have observed a gradual interest rate increase since mid-2017. The change was first experienced in higher yielding cash savings accounts, which was great news for emergency funds and rainy day funds. More recently we have seen an increase in rates across all time frames, from 1-year bonds to 30-year mortgages.

The result has been a decrease in the market value of bonds, which is what we expect. The return on investment for bonds this year have been roughly -1% to -2%. The value of these bonds will increase as they approach their maturities (when the bondholder gets her money back), and interest will be received as a return on investment.

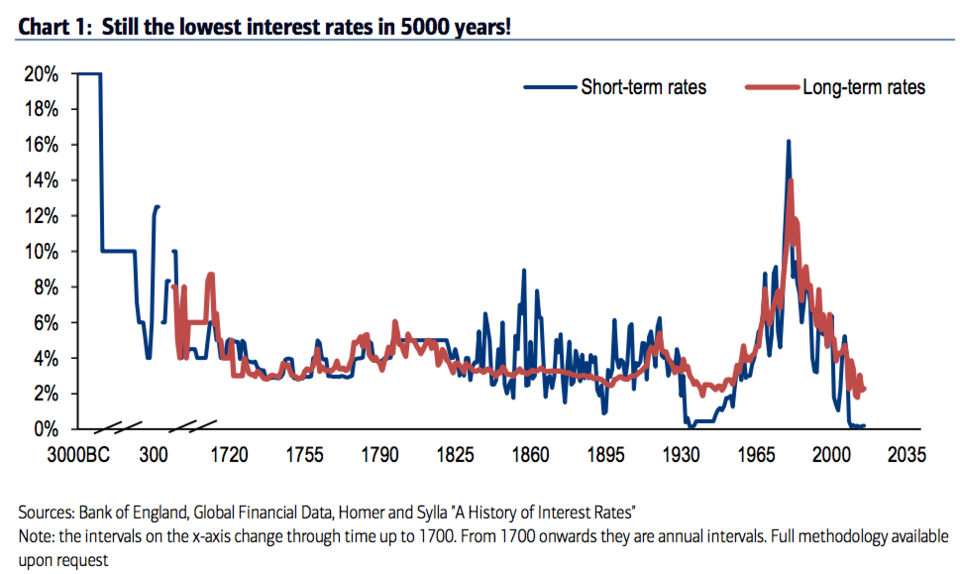

We remain toward the bottom of an interest rate decline that started in 1982! Even after the recent increases, interest rates remain historically very low. A group of analysts at Bank of America performed extensive research to plot the history of interest rates going back 5,000 years! They cite sources referencing the Roman and Byzantine empires. I appreciate their effort!

Return to Blog Page