2018 Year-End Trading

January 15, 2019 | By Kevin Smith, CFA

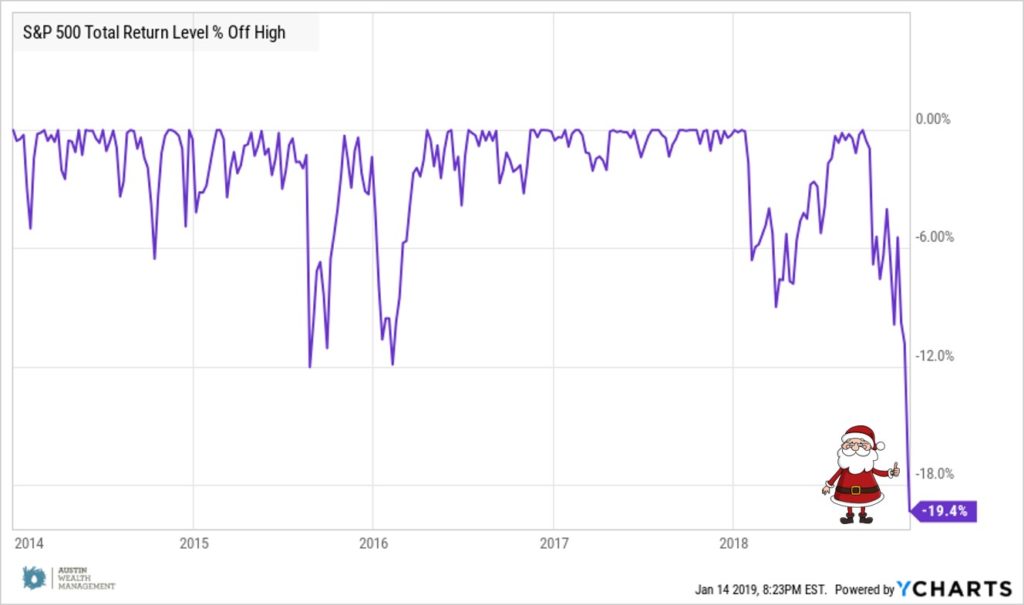

The stock market brought us gifts just in time for Christmas. The chart above show the % declines from all-time highs over the past five years for the S&P 500. Christmas Eve just happened to be the most significant pull back in a long time.

Changes like this unlock opportunities for investors and we were busy scouring portfolios for any we could find. Here are the big ones.

1) Tax loss harvesting

Voluntarily selling stocks at a loss is generally a cardinal sin for long term investors, but this is a worthy exception. Taxable (non-retirement) accounts are subject to capital gain taxes on investments that sell for higher prices than when they were purchased. Tax loss harvesting is the process of selling investments at a loss to offset capital gains that have been realized throughout the year, then temporarily buying similar investments to maintain exposure to the market and avoid violating the wash sale rule. This blog post goes into more detail with an example.

The aim of this strategy is to reduce taxation while earning a return similar to what you would have otherwise received. The sudden dramatic decline in stock prices opened up opportunities to reduce the 2018 tax bill for many clients with non-retirement accounts.

2) Re-balancing from bonds to stocks.

The easiest way to explain this is with a simple example. Let’s pretend on January 1st you had $100,000 invested in $60,000 stocks and $40,000 bonds. We call this a 60/40 portfolio. By December 24th, your stocks declined in value by 20% and your bonds increased by 2%, leaving you with $48,000 in stocks and $40,800 in bonds. Instead of the target 60/40 portfolio you have a 54/46 portfolio, which is more conservative than you intended because the bond portion increased in relation to the stock portion.

Re-balancing means restoring your portfolio to the 60/40 stocks-to-bonds target, which would require selling $5,280 of bonds and buying $5,280 of stocks, allowing you to buy stocks at a 20% discount and maintain your overall target risk level.

3) Reinvesting dividends, capital gain distributions and cash from the sidelines.

Investments pay out cash flow to investors in the form of interest from bonds, dividends from stocks, and capital gains from any investment that sold for a profit. Mutual funds and ETFs distribute this cash flow to investors throughout the year, with the largest distribution of gains taking place in late December. It happened to be the case that 2018 was a year of extraordinarily large distributions of capital gains, so accounts were suddenly heavy with cash at exactly the same time the stock market was falling dramatically.

We deployed this cash across diversified categories of stocks, with emphasis on those that declined the most from their all-time highs.

US Large Cap: -20%

US Small Cap Value: -25%

Emerging Markets: -27%

Emerging Markets Small Cap: -28%

International Developed Market Stocks: -24%

US Real Estate Investment Trusts: -23%

Return to Blog Page