529 Plan Defaults are Deficient

January 15, 2019 | By Kevin Smith, CFA

College funds are designed to be simple so the largest number of people will use them. Signing up is easy. Linking your bank account is easy. Accessing accounts online is easy. Now investing is easy… maybe too easy.

College funds are designed to be simple so the largest number of people will use them. Signing up is easy. Linking your bank account is easy. Accessing accounts online is easy. Now investing is easy… maybe too easy.

Choosing investments is the most daunting part of signing up for a 529 college fund. It involves interpreting the type of investment by reading abbreviated names of mutual fund (Ex: TRP Intl Discovery A). I have been doing this for 15 years and I always need additional research to understand basic characteristics of each investment option.

The industry attempted to solve this problem by creating age-based portfolios that are designed to be appropriate based on how old your child is, and they change over time to become more conservative as you get closer to actually needing to spend the money on tuition, books, rent, etc. This is a great idea and serves investors far better than a confusing list of options.

There is a potential downside to the simple pre-packaged investment portfolios. They tend to be too conservative. I am guessing this has something to do with the fiduciary risk of the 529 provider. The portfolios shift from stocks to bonds as early as age four. Your four year old will not likely spend the last dollar of her 529 funds until age 22, that is 18 years away! That is very likely plenty of time to receive a positive return on stocks, and probably a higher return than bonds. Stocks have historically outperformed bonds by 4% to 8% per year over that timeframe, which could translate to a large dollar amount.

I understand the fear of losing money in a college account, but we can squash the chances of losing money by using time as our friend. Here are the roughly estimated odds of having a positive return on US stocks over different time periods.

- 1 Year: 78%

- 5 Years: 88%

- 10 Years: 95%

- 15 Years: 99%

- Fact #1: Holding stocks longer increases the odds of a positive return.

- Fact #2: Stocks have outperformed bonds over most periods of 5 years or more.

We can use this information to construct a college fund portfolio to balance a higher expected return compared to default age-based portfolios, while taking an appropriate amount of risk.

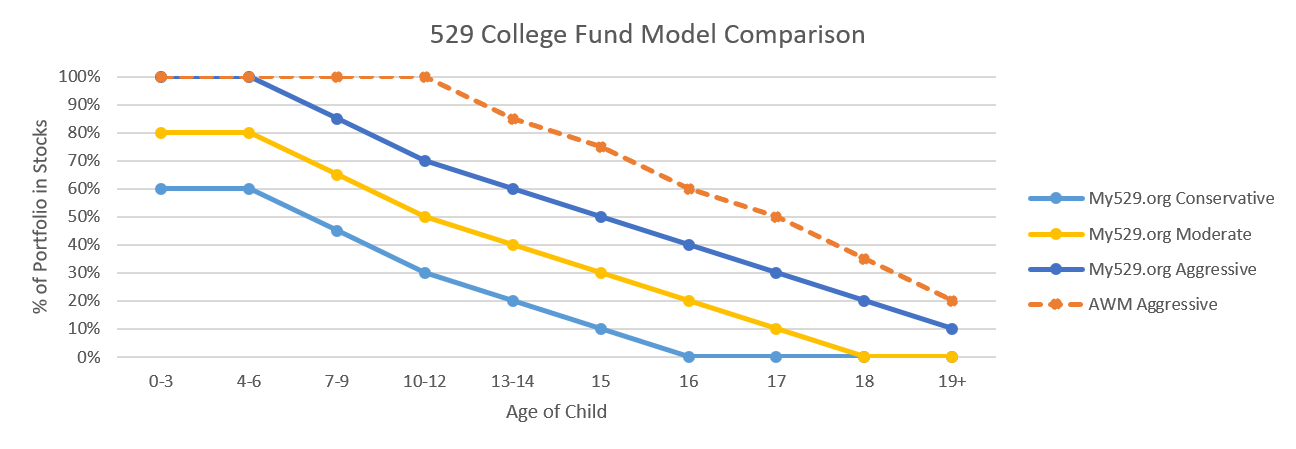

The chart below shows the Conservative, Moderate, and Aggressive default age-based models from the Utah-based 529 plan, compared to our custom Aggressive portfolio. The primary difference is that we stay in stocks longer, allowing for more time to pursue higher expected returns.

I estimate the difference in expected returns between our customized Aggressive model and the default Aggressive model to be 0.25% to 1.00% per year on average over a 20 year period. This will not be appropriate for everyone, but most investors are not aware of how their default age-based portfolios are designed. Some defaults don’t really matter, like changing the ringtone on your iPhone. This one does matter.

Return to Blog Page