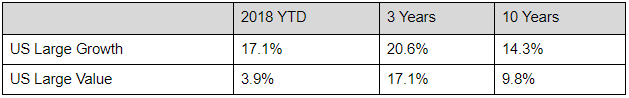

2018 Q3 Trends – Expensive stocks outperformed cheap stocks

October 22, 2018 | By Kevin Smith, CFA

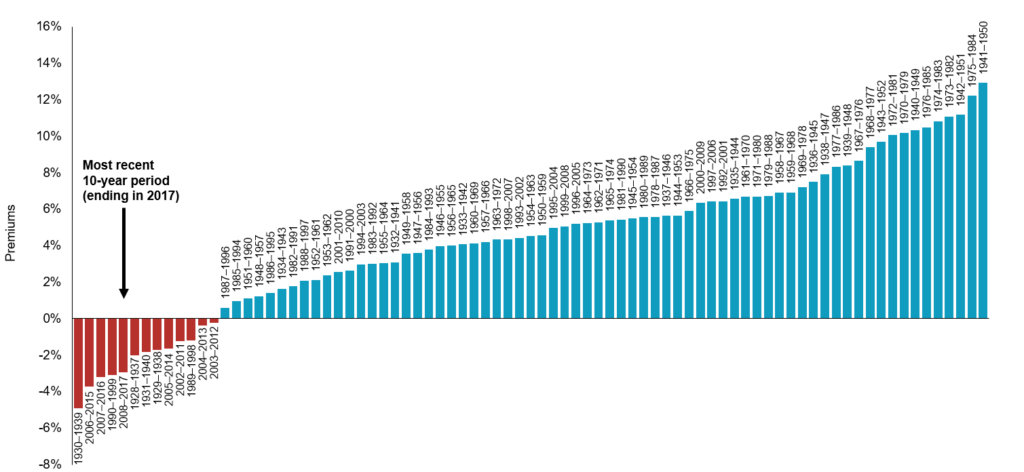

Is the ‘value premium’ dead? Investing with a preference for cheap stocks (named “value” by marketing departments) over expensive stocks (named “growth” by marketing departments) is referred to as ‘value investing’. History provides compelling evidence that investors have received higher returns from value investing over the majority of 10-year periods, and there are sensible reasons to expect this to continue. Many call this investing strategy the ‘value premium’. What happened? Is the market fundamentally different in a way that will provide greater rewards to investors for buying the most favored stocks with the least perceived risk (‘growth’ stocks)? We think probably not. All investment strategies fall out of favor over extended periods and this one does not seem to be statistically unusual when we look at the big picture.

History provides compelling evidence that investors have received higher returns from value investing over the majority of 10-year periods, and there are sensible reasons to expect this to continue. Many call this investing strategy the ‘value premium’. What happened? Is the market fundamentally different in a way that will provide greater rewards to investors for buying the most favored stocks with the least perceived risk (‘growth’ stocks)? We think probably not. All investment strategies fall out of favor over extended periods and this one does not seem to be statistically unusual when we look at the big picture.

The chart below shows the difference in annualized returns between US Value and US Growth stocks over every 10 year period since 1927 – 1937. The blue bars indicate the positive excess return of US Value over US Growth during each 10 year period. The red bars indicate decades when this strategy underperformed. Is a bad 10 year period enough evidence to abandon the strategy? We say ‘no’.

Return to Blog Page