How much MSFT, AAPL, AMZN, GOOGL, FB do I own?

May 21, 2020 | By Kevin Smith, CFA

When you own a diversified portfolio, it doesn’t feel like owning stocks. What you see on your statement is a list of ETFs or mutual funds with names that describe the type of stocks you own “US Large Cap”, “International Equity”, “Real Estate”, etc., but is hard to visualize how much of any stock you own.

At the same time, all we hear about on major media outlets are the names of individual stocks and how well or poorly they have done. “Amazon is up while shoppers lock down.” “Exxon crashes as oil plummets.” “Moderna bio stock soars on vaccine optimism.” It leaves the typical diversified investor not feeling a sense of connection to their investments. How does the performance of any of these stocks actually affect a diversified portfolio?

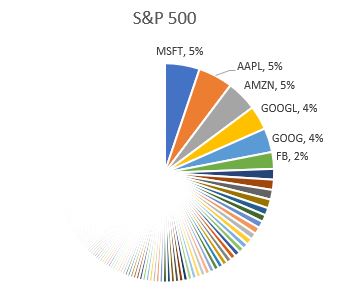

Let’s start with the S&P 500. This is the most famous index, but not everyone knows that it is a list selected by a committee with about 500 companies based in the US (actually 505). These are mostly large companies, but some effort is made to represent all industries. The list is ranked by size from biggest to smallest, so if you own an investment that buys the S&P 500, you own most of the biggest company (Microsoft), second most of the second biggest company (Apple), and so on, all the way to the 505th company (which was Helmerich & Payne Inc as of this morning, a drilling rig company worth about $2B). If you owned ONLY the S&P 500 today, you would have 22% of your investments in Microsoft, Apple, Amazon, Google, and Facebook. You would also own 22% of the smallest 392 companies in the S&P 500, each making up a vanishingly small percentage – so small that Microsoft Excel whites out their pie slices in the chart.

If you own only the S&P 500, your return will generally represent the average return on US stocks, but it will be affected more by the largest companies at the time. For example, Amazon is up 33% so far in 2020 (as of 5/21/20), increasing the value of the S&P 500 portfolio by 1.65%. That is a sobering reality for the passive S&P 500 index fund investor, in which case your portfolio is selected by a committee that is not trying to maximize your return, and they exclude many companies for reasons that may not be relevant to you, but the S&P 500 is a simple way to achieve diversification, capture the average return on most of the US stock market, and all but eliminate the risk of one company blowing up your portfolio.

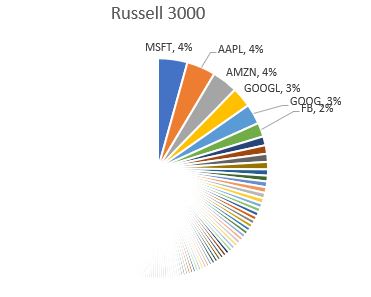

Let’s look at a more broadly diversified index fund, the Russell 3000. This index listed 2,880 US stocks as of today, including far more small and mid-sized companies than the S&P 500. You have never heard of most of these companies, and they are so small compared to the largest companies that exposure to Microsoft only falls from 5% to 4%.

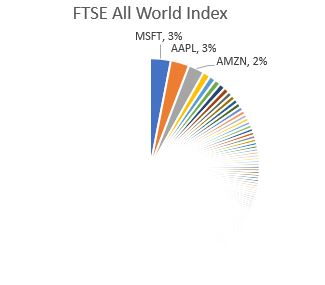

What about a globally diversified portfolio? The FTSE All World Index holds 3,961 stocks in total: 60% in the Americas, 20% in Greater Europe, and 20% in Greater Asia. This portfolio includes 0.8% in Alibaba, 0.7% in Tencent, 0.7% in Nestle, and 0.4% in Samsung, to give you a sense of the international exposure. But even with all of this global diversification, Microsoft and Apple each make up 3% of the total portfolio.

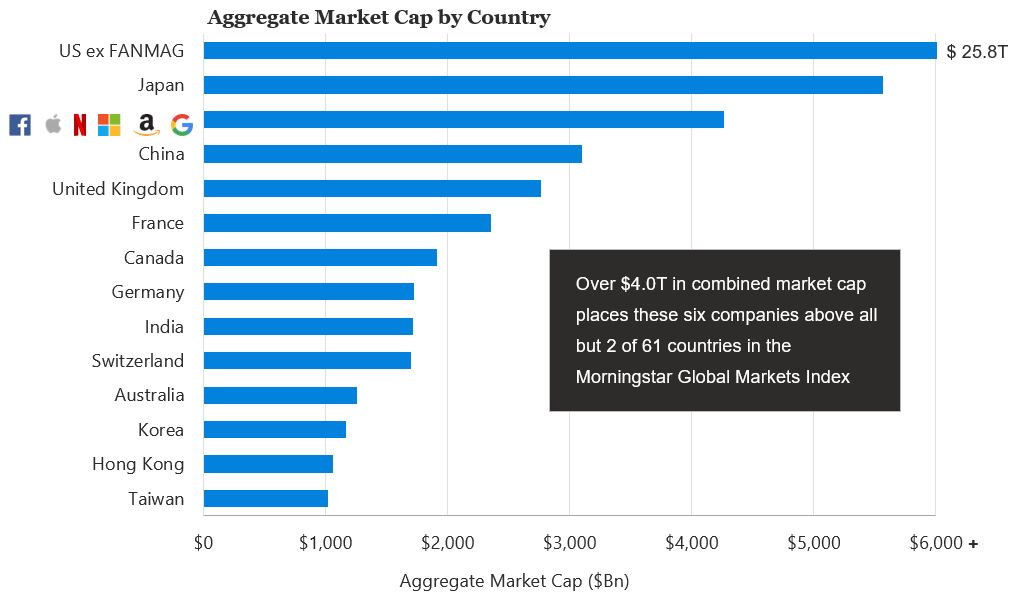

These stocks make up a meaningful part of almost any broad stock market index because they are huge! The shorthand FANMAG is used to describe Facebook, Apple, Netflix, Microsoft, Amazon and Google. Collectively, their total market value is greater than the the total market value of the Chinese stock market (not to be confused with a comparison to the Chinese economy as a whole, which is much larger). The below data is as of 9/30/2019, but the relative scale remains relevant.

Source: https://www.researchaffiliates.com/en_us/insights/how-expensive-are-the-fanmag-stocks.html

If you own a broadly diversified portfolio, you probably have at least 10% of your stocks in the Big 5 stocks everyone is talking about, but your total return will be driven by the average return of all stocks. Diversification takes the fun out of reading the daily headlines!

Return to Blog Page