2024 Q2 Investor Update

April 29, 2024 | By Matt Pierce, CFA

This month we want to highlight some of the key takeaways from our quarterly update video as well as expand on a couple of areas that may be in focus in the months ahead.

Signs of life in the global economy and US manufacturing.

While the US appears to have sidestepped a recession, the global economy slowed materially from the post-Covid growth peak in 2021. China reported some of the slowest growth in decades, and some major economies like Germany likely experienced recessions. While still weak in many cases, sometimes “less bad” bad data is often good enough to gain solid footing in markets. We continue to look for signs of a bottoming and reacceleration in global growth.

Early signs of market leadership broadening beyond the “Magnificent Seven”.

To start the year, the “Magnificent Seven” (Apple, Microsoft, Nvdia, Amazon, Alphabet, and Tesla) look to have dwindled to the “Magnificent Five” with Tesla and Apple getting off to a rocky start in 2024, and while many of those growth names remain strong, several other sectors are showing signs of life. The Q1 performance for Tech and Communication Services comes as no surprise with their Magnificent top components, but Energy, Financials and Industrials have come surging back with double-digit gains of their own. This is a potential sign that the market is similarly coming around to a potential upturn in economic data.

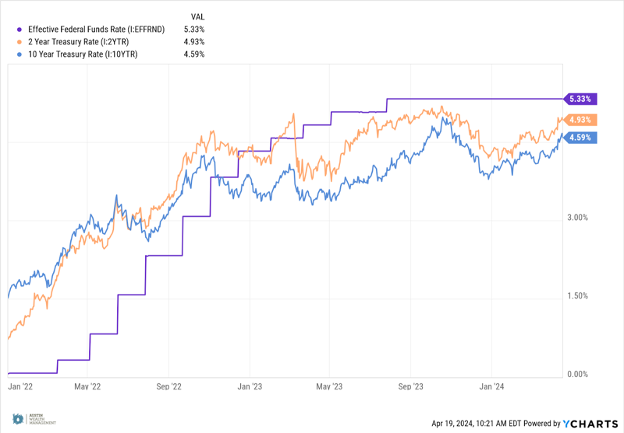

The market looks to have gotten ahead of itself with interest rate cut expectations.

If the US economy has truly engineered the soft landing, or no landing, scenario, rates may remain higher for longer. The Fed and markets are signaling far lower expectations of cuts than prevailed to start the year. Since recording the update, longer-term rates have continued their move higher, and rate cut expectations are for one 25 basis point, or .25%, cut around September. It’s more or less a coinflip for an additional 25 basis point cut before year end. The Fed had been signaling closer to three, 25 basis point cuts, and the market was hoping for even more at 4 to 5 cuts.

Inflation remains stubborn.

In addition to potentially resurgent global growth, inflation remains a challenge to the rate cut picture. Since recording the update video, March CPI came in hotter than expected, with a 3.48% change from the year prior, spurring the rally in interest rates highlighted above. The Fed’s 2% target remains elusive, and if global growth is truly bottoming, it may remain so. Anticipation of a bottom in global industrial production has brought with it a sizable rally in commodities. While off the year’s highs, oil prices are still up the better part of 18% year to date. With that backdrop, a re-acceleration higher in inflation this year certainly cannot be ruled out.

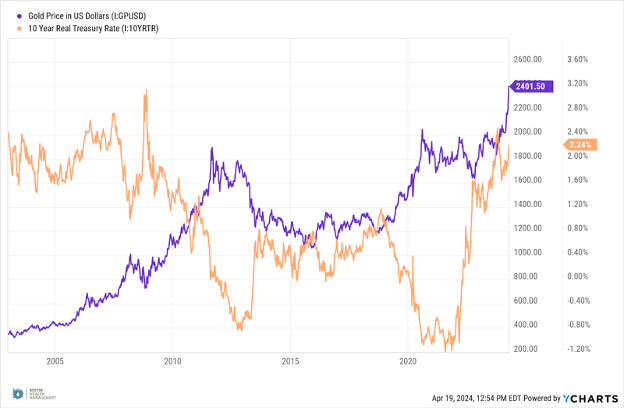

Debt & deficits finally matter?

Our update video closed on the chart below of real interest rates, or the yield offered by inflation protected treasuries bonds (TIPS), versus gold. Typically, rising rates, particularly a real interest rate in excess of the rate of inflation, tends to put the brakes on gold. As gold offers no yield and in most cases has a cost for storage, higher interest rates may make holding gold less attractive to investors. Despite real rates remaining near their highest levels in the last 20+ years, gold has broken out and continues to set all-time highs throughout the year. Perhaps due to the reasons listed above, interest in Bitcoin, or any of a myriad other explanations, US investors do not appear to be driving the price of gold. The demand appears to be driven predominantly by foreign investors and particularly foreign central banks. Is gold’s move to all-time highs perhaps signaling increasing concerns over rising debt and deficits? The jury remains out, but we will certainly be monitoring how this puzzling divergence unfolds.

How does all this impact markets and our portfolios?

The most profound effects could continue to be felt in bonds. Any one of the above items in isolation could make for a challenging year in fixed income, so with potentially many of them happening together, we should not be surprised by continued volatility in the bond markets.

- We have been positioned in lower than average maturity bonds as those are less impacted by interest rate volatility.

As we saw in 2022, any bond market volatility may spill over into other markets as well. For example, more interest rate sensitive equities might be disproportionately impacted by rising rates. In the sector performance chart above, Real Estate is the one negative outlier for the year, and Utilities are also near the bottom of the pack.

- Similar to 2022, our tilts toward factors like value and quality may again be favored.

- Alternatives may continue to shine. Any combination of rising interest rates, reacceleration in inflation, or a rally in commodity prices should benefit this portion of the portfolio and offset volatility elsewhere.

All of these scenarios are impossible to predict, but we can be prepared for whatever the market has in store for us through diversification. The broader that diversification, the more resilient we can be to market challenges, and also, make sure we don’t lose our exposure to market opportunities that tend to emerge when we least expect them.

Return to Blog Page