Optimizing Your Company’s Cash Reserves

October 18, 2024 | By Shane McDougald, CFP®

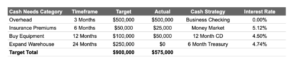

Most individuals and businesses are familiar with traditional checking accounts. However, there are other options that can offer higher interest rates while providing similar levels of protection as traditional checking and savings accounts. The key is understanding your immediate cash management needs and your short term cash management needs, so you can separate your cash into buckets with different purposes.

Here are the advantages and disadvantages of various cash management tools.

Traditional Checking

Advantages:

- Easy Access: You can easily access your money through ATMs, checks, and debit cards.

- FDIC Insurance: Most checking accounts are insured by the FDIC up to $250,000.

Disadvantages:

- Low or No Interest: Most checking accounts offer little to no interest on your balance.

- Fees: Some accounts come with monthly maintenance fees, overdraft fees, and other charges.

In our opinion, checking accounts are for immediate cash needs like month to month expenses. You can consider high yield savings accounts for your non-monthly cash needs.

High-Yield Savings Accounts

Advantages:

- Higher Interest Rates: These accounts offer significantly higher interest rates compared to traditional savings accounts.

- FDIC Insurance: Like checking accounts, high-yield savings accounts are typically FDIC insured.

Disadvantages:

- Limited Transactions: There may be limits on the number of withdrawals or transfers you can make each month.

- Variable Rates: Interest rates can fluctuate based on market conditions.

- Availability: Few banks offer high yield savings accounts to business owners.

High-Yield savings accounts can be an effective way of managing your short term corporate cash needs. What about the FDIC limit of $250,000. Is it worth the risk of keeping money in excess of the $250,000 in one bank? We think you should consider putting the excess of the FDIC limit in treasuries. Here’s why:

Treasury Direct

Buying Treasury Bills at TreasuryDirect

Advantages:

- Low Risk: Treasury bills are backed by the U.S. government, making them a very safe investment.

- Tax Benefits: Interest earned is exempt from state and local taxes.

- Flexible Maturity Dates: Ability to align the timeframe for your cash needs with the expiration date of the treasury bill.

Disadvantages:

- Short-Term Investment: They are short-term securities, which might not be suitable for long-term goals.

- Complicated: Managing the process of buying and selling treasury securities at Treasury Direct can be cumbersome.

- Interest Rate Risk: Can lose value prior to maturity if interest rates increase.

Here’s a brief explanation of the proces. You start by creating an account on TreasuryDirect.gov and logging in. From there, you can select the type of Treasury bill (T-bill) you want to purchase, specify the amount, and submit your order. Most individual investors choose non-competitive bids to ensure they receive the T-bill at the auction’s determined rate. Once your purchase is confirmed, the funds are deducted from your linked bank account.

After purchasing, you can either hold the T-bill until it matures to receive its face value or sell it beforehand through a broker or dealer. The interest earned is the difference between the purchase price and the face value at maturity, subject to federal taxes but exempt from state and local taxes. For convenience, you can also set up automatic reinvestment of your T-bills. This process makes managing your Treasury securities investments efficient and manageable.

If you would rather hand off the process and complexity of investing in treasury bills, and money market funds, you can have your corporate cash managed by the investment team at Austin Wealth Management.

Corporate Brokerage Account

Advantages:

- High Liquidity: Easily convertible to cash.

- Stable Returns: Backed by U.S. government securities, making them low-risk.

- Convenience: ETFs trade like stocks, allowing for easy buying and selling during market hours.

Disadvantages:

- Lower Returns: Generally lower compared to other securities like corporate bonds.

- Interest Rate Risk: Value decreases if interest rates rise.

- Potential Loss: Selling T-bills before maturity could result in a loss if market conditions are unfavorable.

Slight Risk with Money Market Funds: Not FDIC insured, so there’s a slight risk of losing principal.

Return to Blog Page