Tariff-Related Trauma and Your Portfolio

April 16, 2025 | By Kevin Smith, CFA

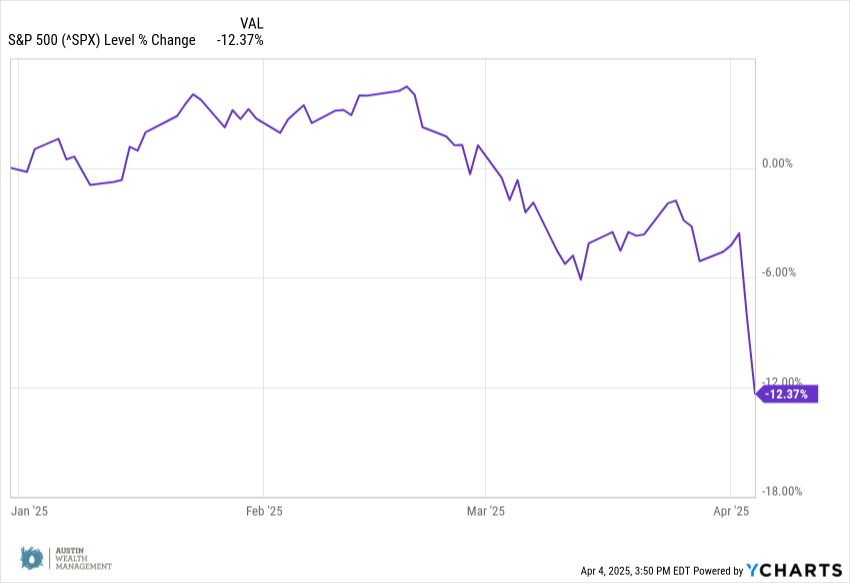

When the headlines scream tariffs, investors flinch—and markets tend to lurch. That’s exactly what happened recently as new tariff announcements triggered a sharp decline in the U.S. stock market. But what’s really going on?

Let’s unpack it.

Who Actually Pays Tariffs?

Despite common political narratives, tariffs are essentially taxes on U.S. companies that import goods. Importers pay them, not foreign countries. These higher costs squeeze cash flows, forcing businesses to make difficult choices—raise prices, change suppliers, or cut back in other areas.

Naturally, investors are trying to make sense of how these decisions will affect company earnings and long-term value. So when tariffs hit, market sentiment takes a hit too.

Volatility Isn’t New—But It’s Still Jarring

Markets tend to overreact to shocks, especially when the implications are unclear. That’s why volatility is spiking. But tariffs aren’t the only story.

There are underlying cracks in the U.S. economy that began forming before this latest round of trade drama.

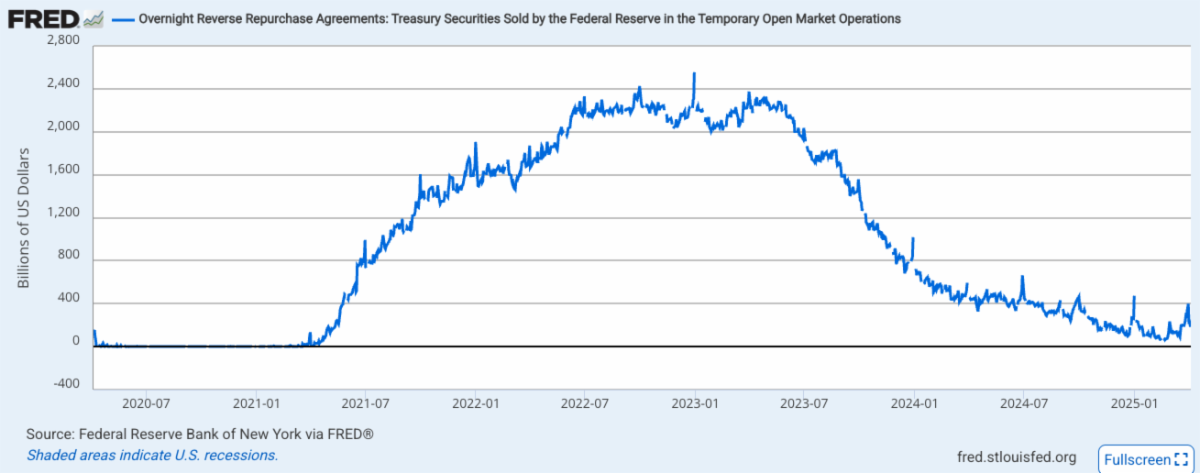

- COVID-era stimulus has finally dried up. The Federal Reserve injected $2 trillion into the system between 2021 and 2024. As you can see in the chart below, liquidity is gone, and credit is tightening.

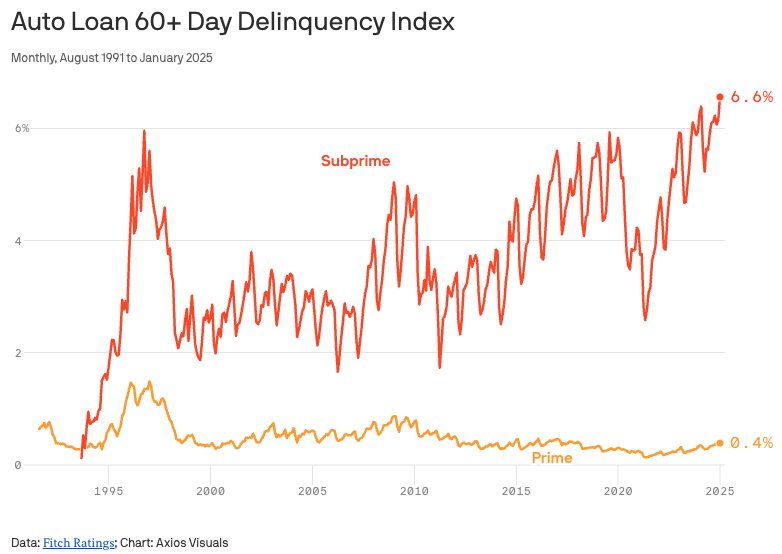

- Car loan delinquencies are rising sharply.

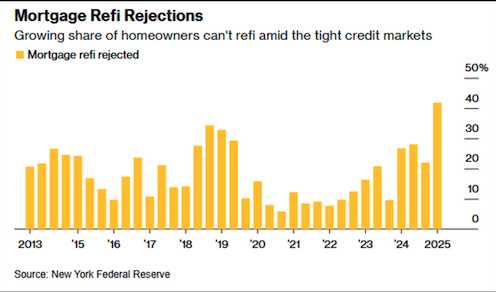

- Borrowing costs are climbing, making it harder to refinance debt, including mortgages:

We’re not in a recession yet—unemployment remains low—but these are concerning signs. And again, they’ve emerged independently of the tariff issue.

So What Should Investors Do?

Don’t invest as if the stock market will go up forever in a straight line. It won’t.

Instead, diversify like you mean it.

And by diversification, we don’t just mean owning a lot of different stuff. We mean owning a mix of assets that behave differently at different times—a key strategy when markets are volatile.

Here’s how we’re putting diversification to work in real client portfolios:

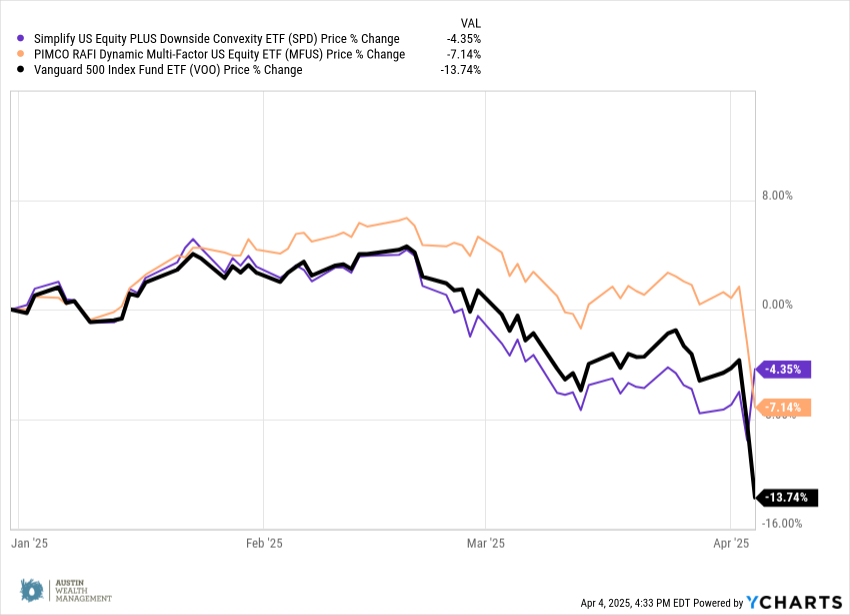

✅ U.S. Stock Strategies (vs. the S&P 500)

We use strategies to invest in large U.S. stocks that differ from the classic S&P 500 index.

-

For example, the PIMCO RAFI fund uses a ‘fundamental’ index, allocating to companies based on their cash flows, profits and other economic measures, rather than on their market cap (stock price X number of shares).

-

Simplify U.S. Equity PLUS Downside Convexity ETF: Owns the S&P 500 with built-in downside protection via low-cost put options.

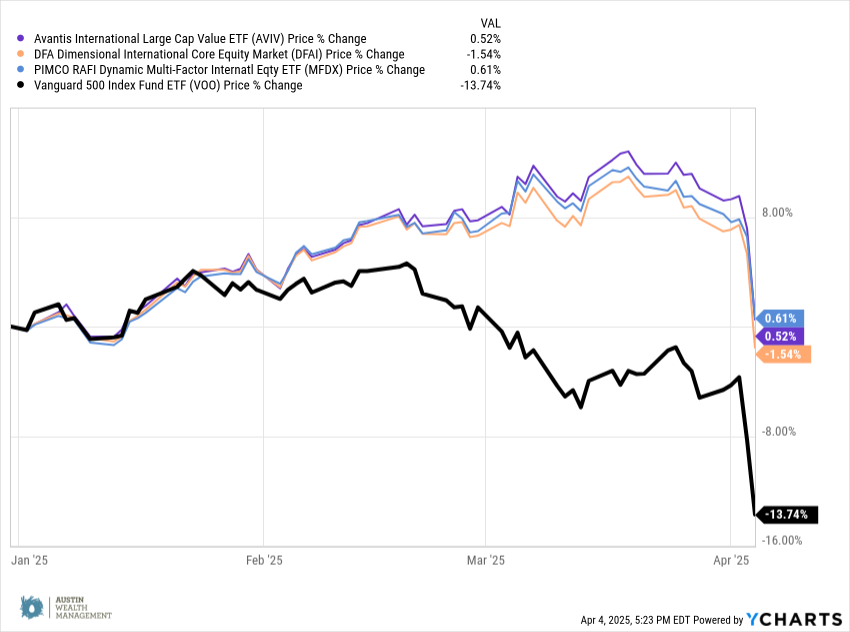

✅ International Stock Strategies

-

Non-U.S. stocks outperformed U.S. stocks by the biggest margin in 10 years during the first quarter. If a baseball player can be ‘due’ for a hit after a long slump, non-U.S. stocks were ‘due’ for outperformance. That’s the power of reversion—sometimes being “due” works in investing too.

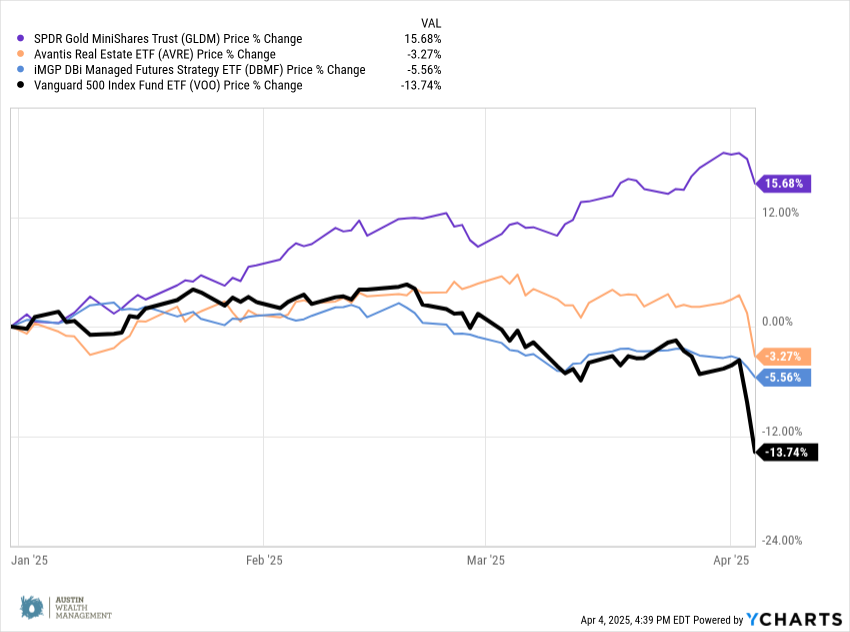

✅ Alternative Investments

-

Gold tends to attract investors during times of fear, and that has been the case recently. Alternative investments as a category have helped offset declines in U.S. stocks so far in 2025.

Return to Blog Page