All Bull Markets Will End… And Come Back

February 28, 2020 | By Kevin Smith, CFA

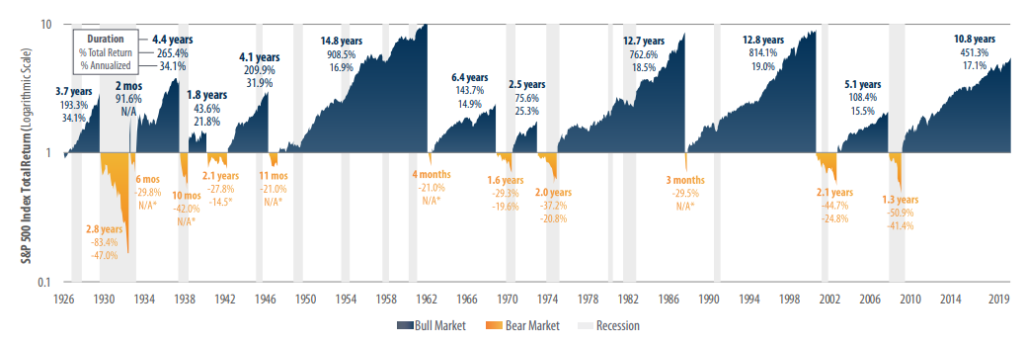

We are still technically in a Bull market and have been for about 11 years. When we zoom out and take a deep breath, there is some solace in seeing that Bear markets tend to be much shorter than Bull markets. It tends to feel like an eternity, but Bear markets have only lasted 1.3 years on average.

Another helpful realization is US stocks have been expensive over the last couple of years, meaning prices rose faster than profits tend to support. Some analysts refer to this as ‘pricing to perfection’. It often takes an event to bring prices in line with historical norms.

One measure of how expensive or cheap stocks are is the Shiller PE Ratio. This is a measure of the total stock market price divided by the average earnings of companies over the last 10 years. The chart below shows the Shiller PE Ratio for the US stock market going back to the late 1800s. This ratio has been quite high recently, implying lower stock market returns until we experience a significant correction.

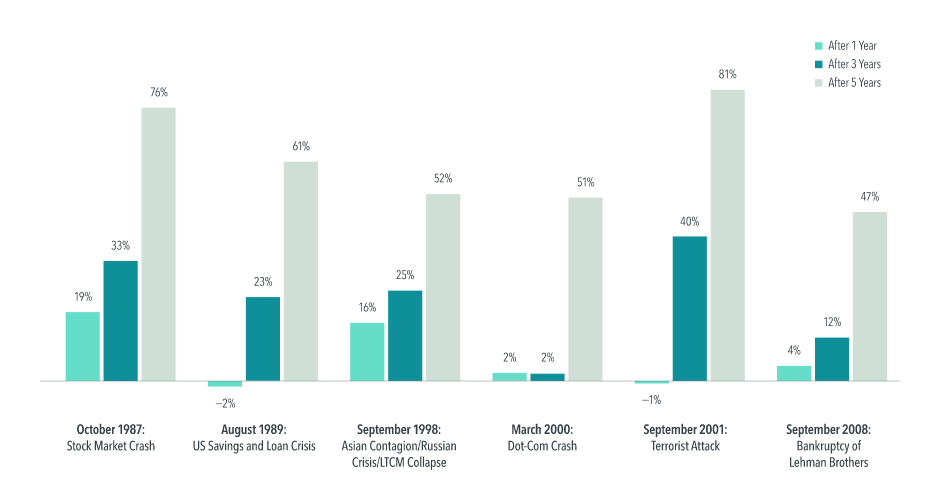

You might be wondering, how did investments do after similar shocks to the stock market. This next chart might restore some feelings of hope. It is a look at how a balanced portfolio of 60% stocks and 40% bonds performed after recent crises. Each crisis had a meaningful recovery within five years, and some of them sooner.

Posted in: Investing

Return to Blog Page