Dealing With The Dips

September 1, 2024 | By Kevin Smith, CFA

Employees get paid for doing work. Investors get paid for taking risk.

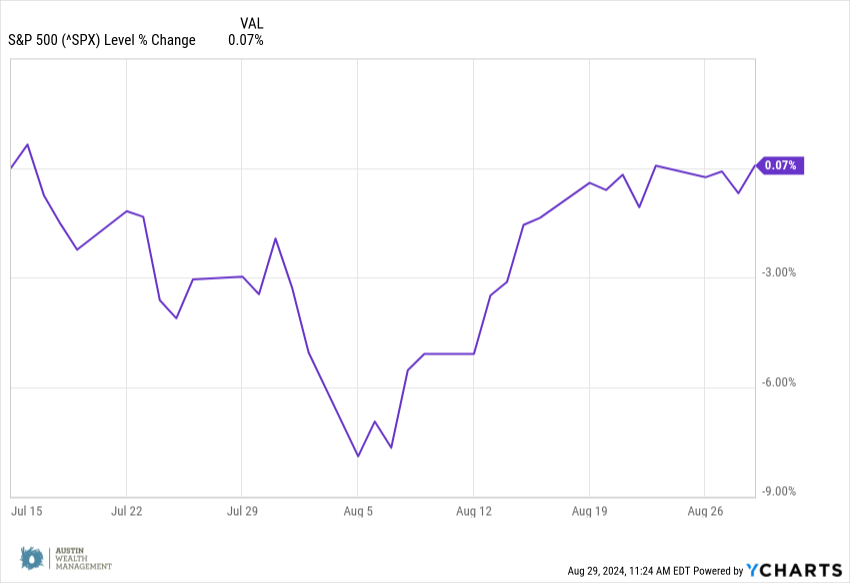

Risk is the chance of losing value between the time of purchase and sale. We experience risk when the value of an asset falls while we own it. Sometimes it falls a little and we call it a dip. Sometimes it falls a lot and we call it a recession. We just had a dip!

HOW FREQUENT ARE THE DIPS?

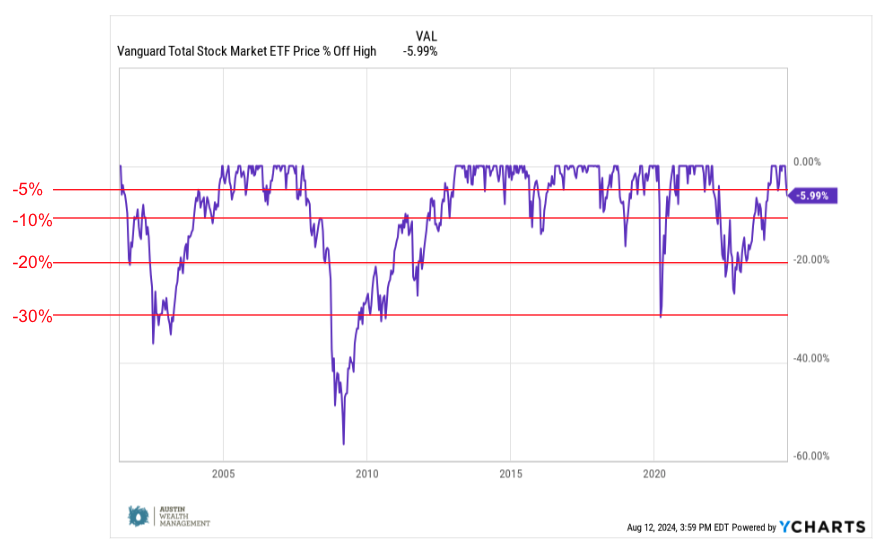

The U.S. stock market declined over -7% between mid July and mid August. It has been so long since we had a proper dip that it caused quite a few investors to reconsider how much they like this risk taking activity.

The financial media tries to pinpoint a single cause for a market dip, providing a simplistic explanation that resonates with the public – most recently the increase in interest rates by the Bank of Japan. That was likely part of the cause, but the global financial markets are far too complicated to draw a one dimensional conclusion. Explaining the past is hard. Predicting the future is harder.

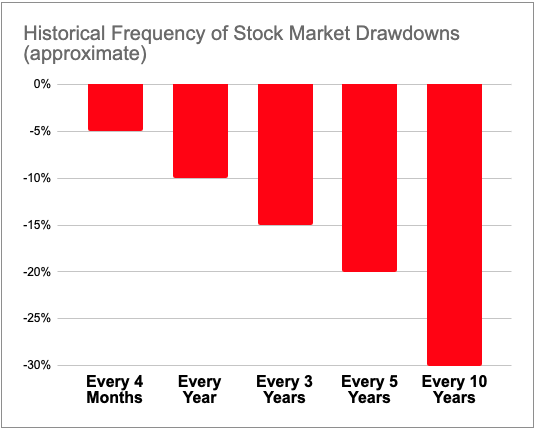

Market dips are inevitable, but their timing and severity are unpredictable. Investors should be prepared to weather these fluctuations—or adjust their exposure to risk accordingly.

This chart estimates the frequency of stock market dips from small to large.

We’ve had some major dips in the past 25 years. Fortunately most have been fleeting. Here’s a look at a recent history of only the “bad” times in the U.S. stock market.

BUYING AND SELLING THE DIPS

Most -5% dips don’t turn into -10% dips. Most -10% dips don’t turn into -20% dips, and so on. Treating every dip like it will be the next ‘big one’ is a low probability strategy, and selling after a dip is usually an act of ‘selling low’, the opposite of what investors are trying to do.

If ‘selling high’ is a good strategy, then ‘buying the dips’ is probably a good strategy. Right?

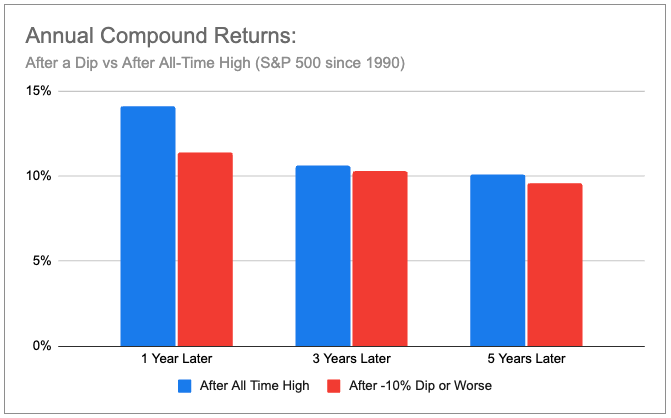

Well… maybe. Take a look at the chart below.

This sobering data suggests there isn’t much of an advantage to buying dips versus buying at all-time highs. That is probably not what you expected to see! I was shocked when I first saw this.

It is important to take into account the multiple raging bull markets that took place in the U.S. between 1990 and 2024, which boosted returns after all-time-highs. There have been great times to buy dips that generated unusually large returns – for example buying the dip in the early stages of the COVID crisis.

It is a good idea to buy into dips if you have excess cash and plan to use it for investing. There is wisdom in gradually investing a large lump sum of cash into the stock market over time, rather than all at once. This strategy mitigates the risk of investing just before a potential market crash, while still allowing you to take advantage of opportunities to buy dips at lower prices.

The broader lesson is investors are statistically better off getting into the market when they have excess cash to invest, rather than waiting for the optimal time to jump in. We can only know the optimal time in hindsight.

A SIMPLER STRATEGY

If buying the dips isn’t as compelling as we hoped and buying the all-time highs isn’t as bad as we thought, what are we left with?

Sometimes the most boring approach is the most reliable: buy into your optimal portfolio whenever you can, and only sell when you need the money for spending. This approach allows investors to use time as a risk management tool.

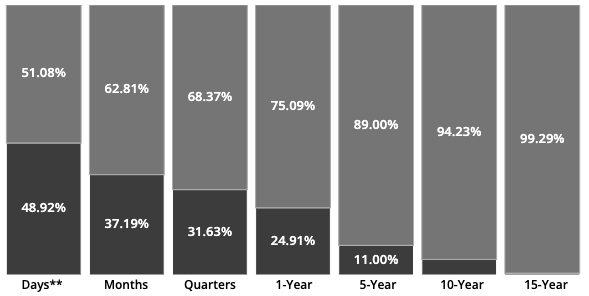

The chart below shows the frequency of positive returns (light gray) and negative returns (dark gray) over different time periods investing in the S&P 500.

Source: https://www.ifa.com/

A helpful rule of thumb is to always be prepared for at least a five year commitment when investing in stocks. This boosts your chances of a positive return. Hold for 10 years or 20 years to increase your chances even more. Just be prepared from many dips along the way.

And…. we’re back.

From the time I started writing this article in early August to the time I finished at the end of August, this recent market dip is already in the rearview mirror.

Return to Blog Page