Elections and the Stock Market

August 14, 2020 | By Kevin Smith, CFA

I did not predict anything about 2020, including that the Presidential campaign three months from election day would be so quiet. You can’t escape it if you are glued to cable news or Twitter, but by comparison to past elections, it is surprisingly low key, particularly considering the clash of personalities and the tenuous social and economic conditions. At this time in 2016, I recall being inundated with Trump vs Hillary 24/7. While the campaign is unusually quiet, investors are asking the same questions they always ask during elections.

Many investors are preparing for a big market selloff as a result of election activity. Having been in the financial services industry for five Presidential elections, I can report the direction of concerns is related to party affiliation. In 2016, Democrats feared a Trump victory would be a disaster for markets, and Republicans feared a similar disaster with a Clinton victory. I vividly recall similar conversations in 2012 with Obama and Romney, and here we are again with Trump and Biden.

It may feel like this time is different for compelling reasons (pandemic, trillions of new stimulus dollars, social tensions, political divisions, China relations, and on and on), but I recall the last several elections being considered the most important with the future of America at stake. Broadly speaking, elections are followed by more of the same with slow moving changes at the edges, and the big changes are heavily moderated by the political process by time they pass.

Presidential administrations influence tax policies, market regulations, relationships with foreign markets, and plenty more, but most of the effect is indirect. America’s businesses and investors collectively have a massive impact on the economy as they work feverishly to create value no matter what is happening in Washington, D.C. We are all tempted to boil the vastly complex and interconnected markets and institutions into a simple “if this, then that” equation, but a more humble and less partisan approach will likely generate a better investing strategy.

Here is a simple exercise to help think about how difficult it is to successfully invest based on election outcomes.

- How confident are you that the candidate who is bad for markets will win? Say 50%

- How confident are you that markets will actually drop if that candidate wins? Say 80% (in the spirit of being humble)

- How confident are you that markets will drop enough to create a meaningful investing opportunity, -10% or more? Say 50%

- How much of that opportunity will you likely capture by selling and buying at the right time? Say 50%

Using this basic logic, the investor has a 10% chance of success. The math is 50% X 80% X 50% X 50% = 10%. Having a 10% chance of making perhaps a 5-10% additional gain does not sound like a great strategy, particularly if the cost of being wrong is a positive expected return from simply staying invested.

History can’t tell us what will happen next, but it can help us create a baseline for expectations. Then we can make adjustments using our special insight, to the extent we have any.

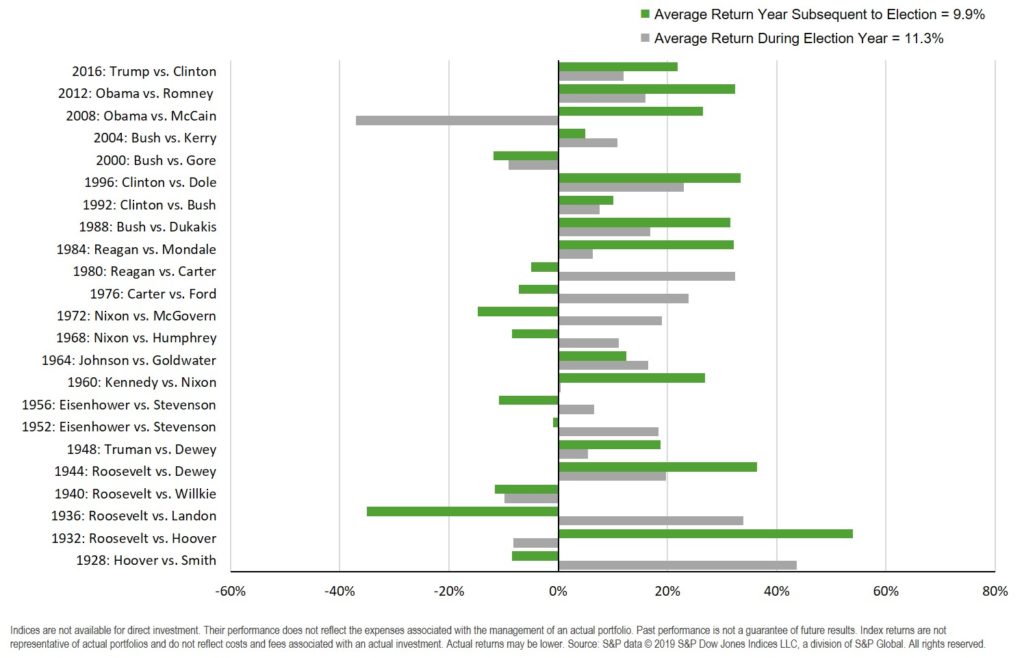

On average, market returns have been positive both in election years and the subsequent year, meaning those who bet on a stock market sell off have been wrong most of the time. The last two election periods in which stock market returns were negative were during 2008 (global financial crisis) and 2000 (dot com bubble). In both cases, the election results were incidental to market losses.

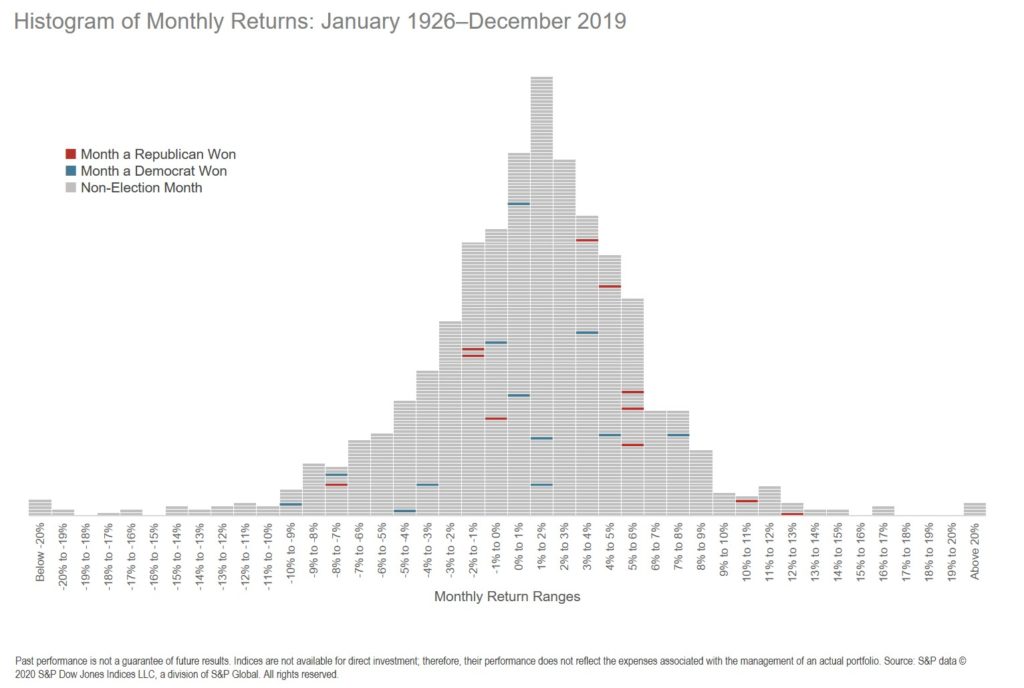

For those investors planning on cashing in on a dip in November, here is your data set. The blue and red blocks indicate Presidential election months going back to 1926. The few outlier data points do not make for a compelling investment strategy in my opinion. I see a random scattering of outcomes that fall roughly within the total bell-shaped distribution.

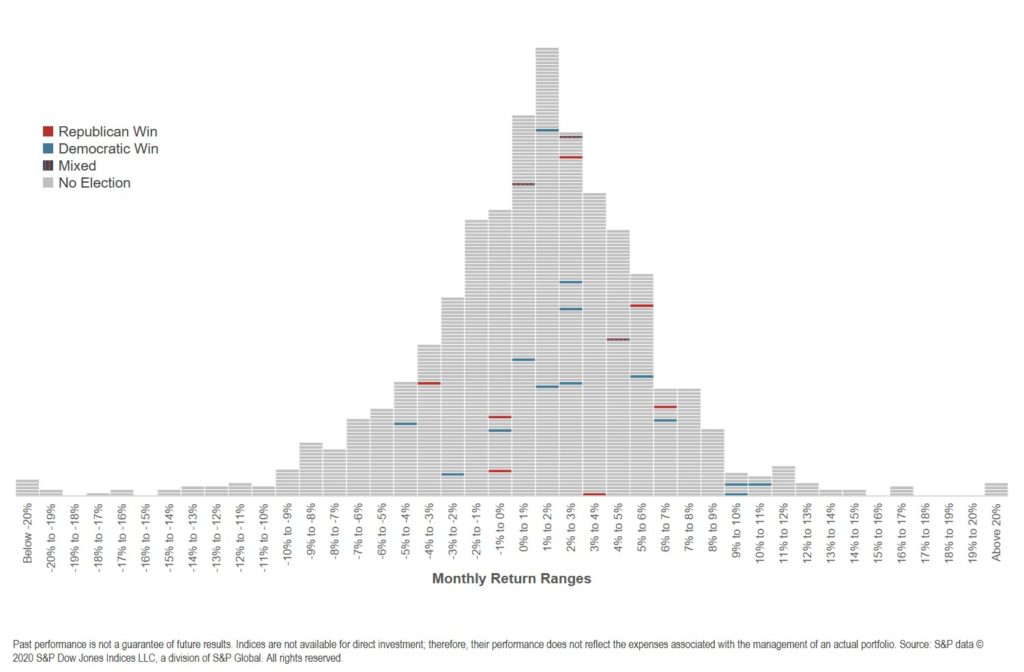

What about mid-term elections? I don’t see a compelling pattern to use for successful investing here either.

As usual, the odds are stacked against the short-term market guessers, but that won’t stop investors from trying. The psychological torment of investing during election periods is real and for those who suffer the most, it may be prudent to reduce risk exposure temporarily, but to a modest degree and with a clear plan to return to an appropriate risk/return profile. And to the gamblers, I say limit the size of your bets and be careful not to attribute success or failure to your keen insight or lack thereof.

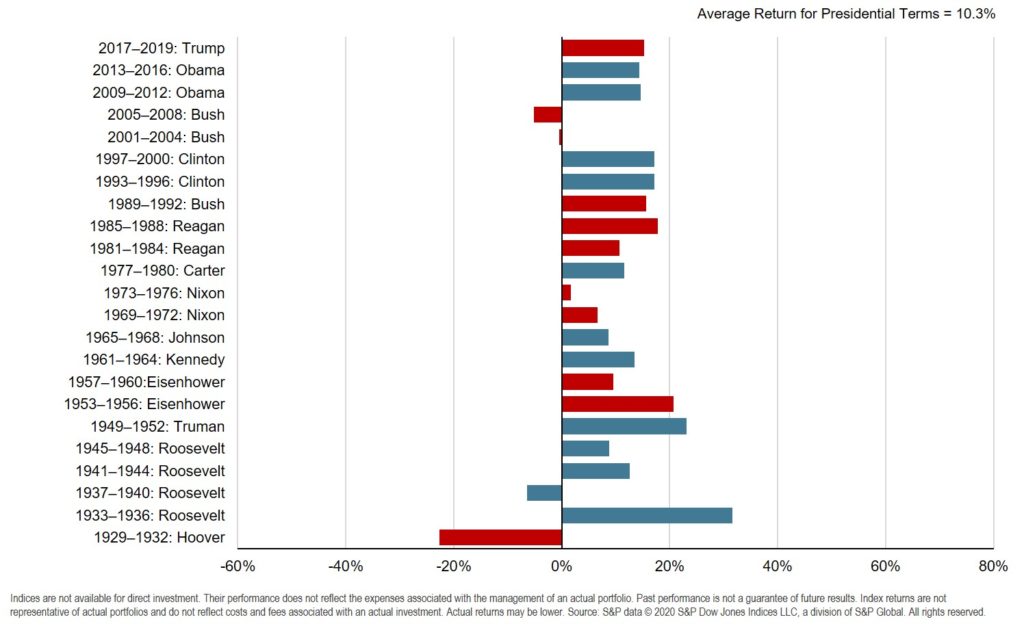

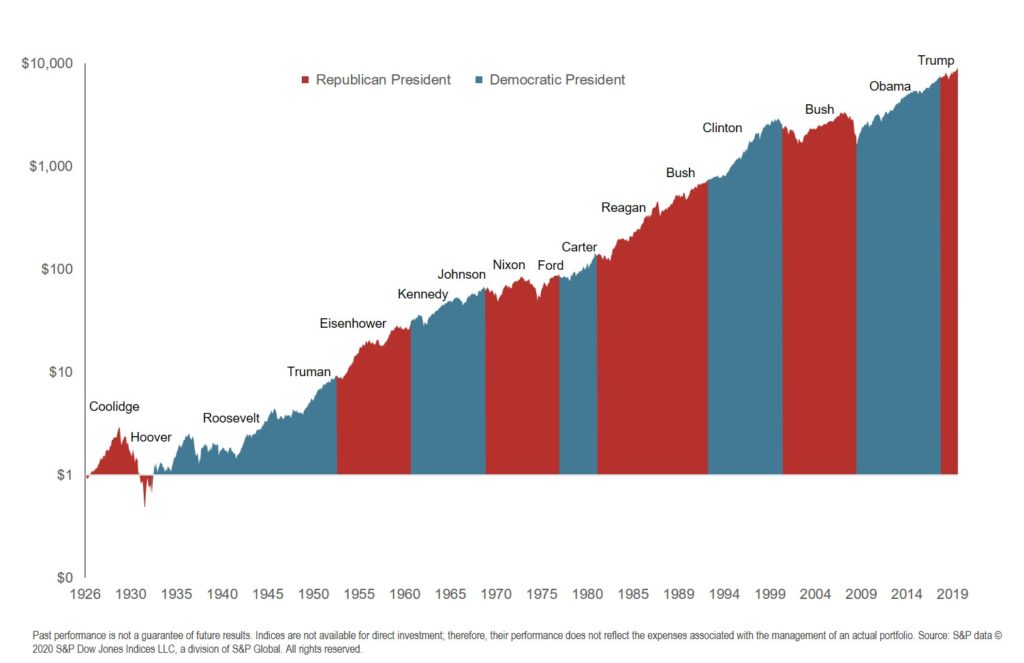

What about after the election? Is there any evidence that Democrat or Republican-led administrations have been associated with better or worse stock market returns? I can’t find a meaningful pattern in the data. The chart below shows the average annualized stock market returns during Presidential terms.

The cumulative stock market return also suggests that markets persist regardless of who is President.

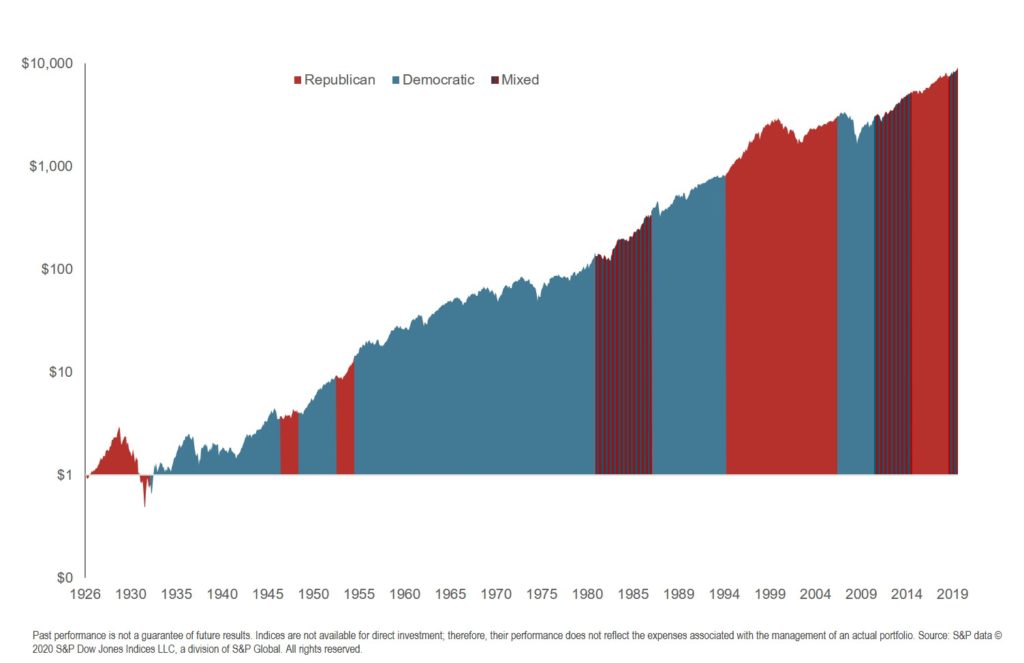

What about Congress? They have more direct influence over the legislation that directly impacts taxation, regulation, and policies that affect businesses and their consumers. We don’t see a meaningful pattern of under or over-performance of either party while in control.

I won’t be surprised if stock market prices gyrate more wildly as we near the election and in the subsequent months. Speculative activity will increase and longer term investors will update their expectations and all of that will reflect in price changes. As exciting as all of that may be, the odds of profiting from it are low. Investors are rewarded by contributing their money to companies that create value in the economy. On average, over time, more companies have created value than have destroyed it and investors have received a positive return, regardless of the elected officials. The higher probability bet is that this relationship will continue, so as prudent investors we should discount our personal notions of how elections will impact markets, however dear we hold those beliefs.

Return to Blog Page