From Vanguard on the Future

December 6, 2018 | By Kevin Smith, CFA

Vanguard stepped up its research capabilities and provided more information to investors in 2018 than ever before. Their market outlook for 2019 is particularly well assembled. My cliff notes are below and you can find the entire paper here.

- Short term expectations (1-2 year outlook)

- Growth slowdown led by US and China

- Not likely to be a US stock market collapse or recession

- Inflation in the US should stay low, near 2%, even with tariffs and higher wages

- The Fed will likely stop rates at 2.75% to 3.00% mid 2019 and wait

- Continued stock market swings are likely

- China’s growth should slow, but they will actively fight it

- Euro area growth should rebound

- Long term expectations (10 year outlook)

- Lower return expectations are driven primarily by

- a) current high valuations of stocks (investors paying a premium)

- b) low interest rates that will likely rise

- US bond returns 2.5% – 4.5% annualized

- Global stock returns 4.5% – 6.5% annualized (with US lower than Non-US)

- Improving returns from Non-US developed markets

- Lower return expectations are driven primarily by

- Major risks

- US Federal Reserve raising rates beyond 3% in 2019

- US-China trade tension extends beyond tariffs

- China’s growth slows down faster than they can deal with it

- Global debt levels are historically high – primarily corporate debt

- Investor takeaways (my interpretations)

- Generally lower expected returns over the next 10 years meas:

- Savers need to save more to achieve wealth objectives

- Retirees need budget discipline and patience with markets

- Investors should expect different results compared to the last 10 years

- US stock market expectations are 3% to about 5% per year (average). Non-US stock market expectations are more like 6% to 8%. This implies potential benefits from global diversification.

- Returns from bond investments are generally higher over the next 10 years because of higher interest rates. Corporate bonds may add more risk than potential reward, so investors should be cautious. Shorter term bonds provide similar return expectations with less risk than long term bonds, so they should be favored. Non-US bonds provide diversification against US market risks with similar expected returns, so they should be included in a portfolio.

- Generally lower expected returns over the next 10 years meas:

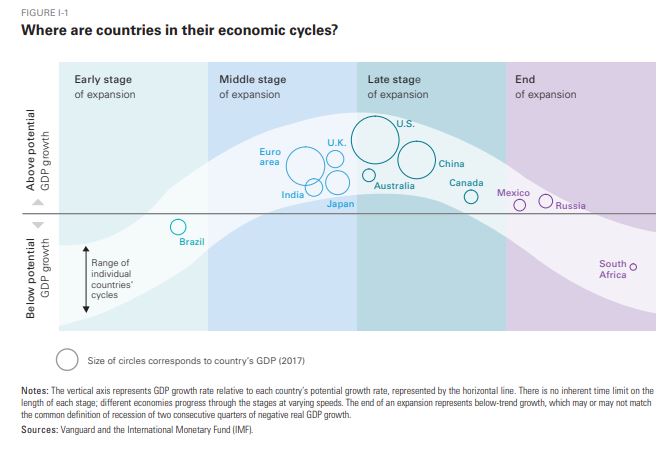

My favorite visual aid from their paper…

Posted in: Uncategorized

Return to Blog Page