Game Stop Lessons

February 15, 2021 | By Kevin Smith, CFA

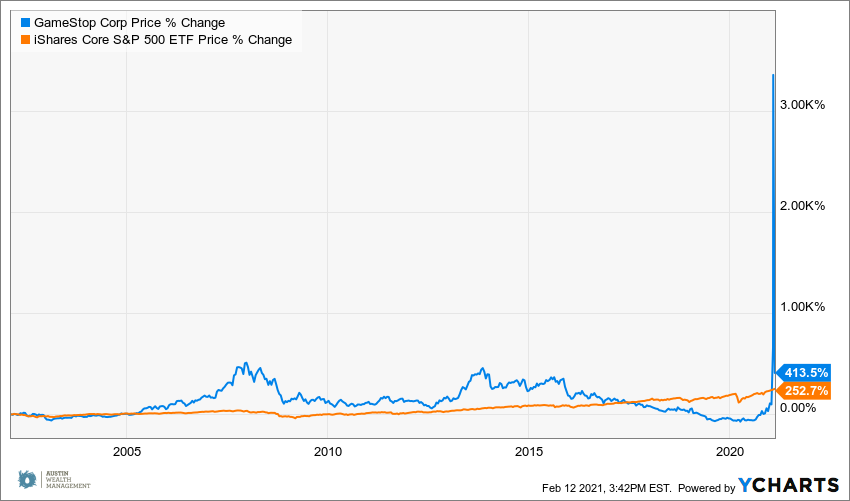

You may have read a dozen articles about Game Stop last week, or maybe none, but you probably heard the buzz: regular folks getting rich and hedge funds losing billions. There is much to learn from the story that created the massive blue spike in this chart.

I went to a GameStop store in December to buy a Nintendo game for my son as a Christmas present. I had three games in mind and found none of them. I went home, got on their website which was clunky, then quickly bailed and bought it on Amazon. GameStop was not good at the one thing I thought they did: selling video games.

People stopped going to retail stores for much of 2020, implying a bleak future for the GameStops of the world. So dire that several hedge funds made massive bets that GameStop would fail. They did this by ‘short selling’ the stock. This means borrowing shares, selling them at the current price, then hoping to buy them back at a lower price before returning them. At one point 140% of all GameStop shares had been ‘sold short’. Yes, that is actually possible.

But what if GameStop transformed into a world class online gaming platform? This was the investing thesis of some institutional investors, including hedge funds and mutual funds, and evidently some non-professional investors hanging out on Reddit chat forums. In other words, GameStop stock would actually be considered cheap if they could successfully transform their business to e-commerce. Some investors called it a ‘deep value’ stock.

That is how the story started, then it got weird.

Reddit is a type of online forum for people to share and discuss ideas, make jokes, waste time, and share content about anything you can imagine. WallStreetBets is a popular subgroup of mostly non-professional investors kicking around ideas about trading stocks, and they seem generally interested in empowering the average individual investor. Here is Keith Gill, the most famous GameStop Reddit user.

Gill had been a vocal champion for GameStop as a value stock for many months heading into the GameStop explosion. For some legitimate and strange reasons that make things on the internet take off, the GameStop idea started going viral on Reddit. Those users became investors, some bragging to each other about gains and losses with screenshots of brokerage accounts. Many were buying call options on GameStop, which for technical reasons, requires more buying activity by the clearing broker, pushing the price up even further.

As the stock price started to rocket upward from $18 at the beginning of January to $65 by January 22nd, the idea of creating a massive ‘short squeeze’ on the billionaire hedge funds became a popular narrative, drawing more investors to the party. A short squeeze happens when short sellers are forced to buy back shares at higher prices, with unlimited loss potential. The higher the price, the bigger the loss for short sellers. A David vs Goliath narrative took hold as hedge funds took real losses in the billions.

Enter Elon Musk, who had been successfully fighting off short sellers of Tesla stock, and openly critical of short selling as a practice. He tweeted “Gamestonk!” on January 26th and the price shot up 92%, where it peaked at $341, making instant millionaires out of early investors.

Two days later, Robinhood, the most popular day trading platform, and several other brokers stopped executing ‘buy’ trades of GameStop, and several other stocks tied up in this phenomenon. The media narrative was quickly picked up by opportunistic politicians, claiming Wall Street coordinated against lowly retail investors to protect their own interests at the cost of the helpless and vulnerable. Some Wall Street bankers defended their turf, claiming regulation would be needed to limit market manipulation and protect the valuable and necessary work of short sellers.

The stock price of GameStop dropped rapidly in the following days as the ‘short squeeze’ dissipated, creating huge losses for those who arrived late to the party.

Did the Redditors do something wrong or illegal? They didn’t clearly misrepresent GameStop as something it wasn’t. In effect, their online forum could be compared to an investor club gathering at a Red Lobster every other Friday and buying stocks together.

Are the hedge funds the bad guys? They made massive bets on the failure of a fledgling company, and that activity created downward pressure on the price, so being the target of short selling is no fun. But they did this at great risk to their own wealth, we now clearly know. Other hedge funds were quick to take advantage of the situation and generated massive profits. For every loser, there is a winner in stock trading.

Pop culture paints hedge funds as the bad guys on Wall Street, but in reality many hedge fund managers left big banks to have more freedom and now trade against their former employers. On the other hand, index funds are considered the purist form of investing: low fees, simple, diversified, and easy. One downside of index funds is their requirement to buy stocks without a choice. If the stock is in the index, they have to buy it. As GameStop grew in size by market capitalization (share price X total shares), it became a larger part of some indices, forcing index funds to buy at inflated prices. It probably wasn’t too much of a problem in the end because GameStop was only 0.05% of the US stock market index at its peak price.

What about the brokerage firms like Robinhood, and their clearing partners like Citadel? Did they do something wrong here? As much as it seems like halting trading activity was a terrible customer service decision at best, and maybe nefarious at worst, Robinhood functions more like a bank than most people realize, meaning they participated in substantial credit risk during the wild GameStop trading. It takes two days to settle a stock transaction, and a lot can change in two days!

The firm that guarantees the settlement of trade is called DTCC. For example, if DTCC buys a stock to match with a seller on Monday and find their stock worth half as much by Wednesday before they are able to close out of their position, they would have a big loss on their books. In order to take that risk, they require broker’s like Robinhood to post collateral for their clients’ trades. The amount of collateral is determined by government regulations tracing back to the Dodd-Frank Act in response to the financial crisis in 2008.

Apparently Robinhood was forced to come up with $3 billion in collateral during peak trading of GameStop, which caused them to take action to reduce trading.

Who made money? The brokers executing the trades of GameStop likely did quite well. Hedge funds who took advantage of their less fortunate hedge fund counterparts made handsome profits. The early investors who believed in GameStop as a turnaround stock can likely retire quite comfortably. Some speculators made a quick buck if they got out soon enough.

Who lost money? The hedge funds with the initial short sale bets lost a ton, and at this point, so did most speculative investors who paid over $150/share during the height of trading activity.

This was a story about a technical trading phenomenon. Was it also a social movement if ordinary people taking on Wall Street and beating them at their own game? Maybe for a minute. If this was the beginning of sustained coordinated ‘attacks’ against large short sellers, there could be severe consequences for the stability of markets, but that seems unlikely.

This was also a story of ordinary people goofing off on the internet together and getting tangled up with elite hedge fund managers, creating lots of trading activity, which tends to favor institutional investors, brokers and bankers. I am curious why something like this didn’t happen sooner.

It is another lesson in the power of the internet to coordinate people and ideas to action, spontaneously and at scale.

Posted in: Investing

Return to Blog Page