What do insurance companies invest in?

September 24, 2014 | By Kevin Smith, CFA

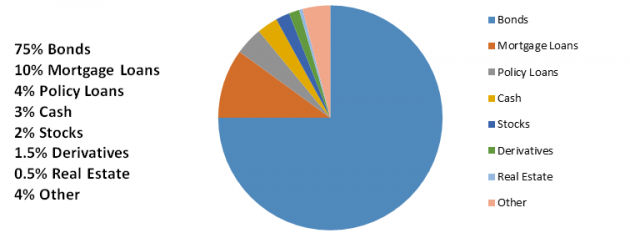

It is important to keep in mind what insurance companies are actually investing in when considering the features of annuities and cash value life insurance contracts. According to a paper published by the Federal Reserve Bank of Chicago in April 2013, “U.S. life insurance companies own more than $5.5 trillion dollars in real and financial assets.” Here is the breakdown they published for the general account assets of life insurance companies.

Notice that there is not a significant category of extraordinary investments that only the insurance companies know about. If you own a fixed insurance investment such as a universal life policy or a fixed annuity, your premium dollars that are being invested on your behalf go into the insurance company’s general account, and are largely going into bonds and other fixed income instruments. This makes sense because the insurance company is in the business of paying out benefits and accommodating withdrawals, so they must have low risk assets to create liquidity.

Historically, bonds have experienced long term stability and modest returns relative to higher risk portfolios of stocks, and the expected return on bonds should roughly be the interest they pay. If you are seeking long term returns well in excess of bonds, you are not likely to achieve that here. This is not a criticism of the investment teams within insurance companies, it is simply a recognition of their investment objectives, which is made evident by the allocation of their collective portfolio.

This raises the question of what value does an insurance company provide to a long term investor after their operating expenses and sales commissions are accounted for? Particularly if an investor could replicate a similar investment strategy by hiring professional mutual fund managers at a lower cost, for example. There may be tax benefits and creditor protection when investing with an insurance company and safety nets if the insurance company fails, such as the Texas Life & Health Insurance Guaranty Association, but do they add enough value to be a worthy alternative to traditional investment portfolios? The answer is situational, but the question should always be asked.

Insurance is an important component of wealth management. It is used to transfer financial risks to organizations that are willing to absorb that risk because they can spread it across many customers. However, if you are using an insurance company to manage your investments, make sure you understand how they are investing your money relative to your alternatives, and always take into account the fees you are paying.

Source Author: http://www.chicagofed.org/digital_assets/publications/chicago_fed_letter/2013/cflapril2013_309.pdf

Source Data: Authors’ calculations based on 2011:Q4 data from SNL Financial.

Return to Blog Page