Investing for the Unknowable

September 22, 2021 | By Matt Pierce, CFA

By Matthew Pierce, CFA

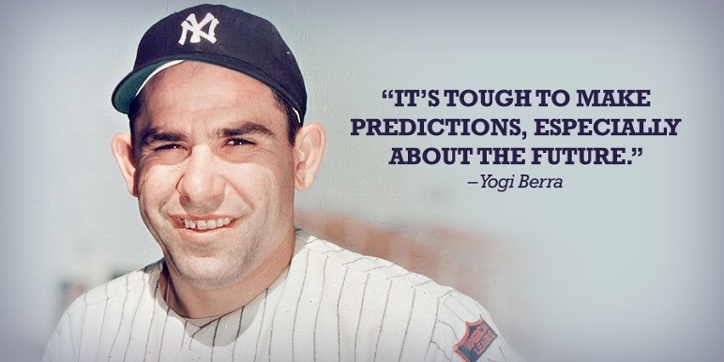

Yogi was right, and it’s particularly difficult when it’s your hard earned money on the line!

Uncertainty never goes away, it just changes shape. It is the water we swim in as investors, so we should take a healthy dose of humility before making predictions. Fortunately, preserving and compounding wealth does not require knowing the future. We can express humility in portfolio construction using diversification. True diversification creates resilience to the vast number of potential outcomes.

Donald Rumsfeld famously described planning for both the “known unknowns” and the “unknown unknowns.”

I think it’s an important exercise to envision different future states of the world. If for nothing else, there are psychological benefits to thinking through these scenarios: both the opportunities and the risks. I like reading about and thinking through the market’s crisis du jour before it’s in the headlines to reduce the element of surprise.

It was in this spirit that Kevin and I explored the unknowable on a recent podcast where we covered some of what we view as the more salient potential future paths.

Scenario #1: More of the Same

A 2020s that looks much like the 2010s. U.S. stocks could continue to dominate, particularly large cap growth/technology names, and pretty much everything else lags behind.

Scenario #2: Mean Reversion

Mean reversion simply means assets that deviate significantly from their average tend to revert back to those longer-term averages (oftentimes with a pitstop at the other extreme). In this scenario, the 2020s could see assets that have underperformed, and are perhaps undervalued, go on to outperform those that have recently done well.

Scenario #3: Random

Human beings have an uncanny ability to attach narrative to even the most unexplainable and erratic of phenomena. The 2020s could defy all our well-thought out narratives, and the results could look nothing like anyone expected.

Scenario #4: Lost Decade

Both stock and bond markets could realize incredibly muted to nonexistent returns. Similar to the first decade of the 21st century with the added feature of historically low interest rates.

Scenario #5: Gloom and Doom

My colleague, Derek Ripp, labeled this the “Peter Schiff was right” scenario (sorry, Peter). Global indebtedness or some other calamity could lead to a massive deflationary bust, or a bonfire of fiat currencies leads to hyperinflation.

Scenario #6: Breakthrough!

The arc of humanity is one of continued innovation and invention. New technologies in development or yet unimagined could lead to a massive breakthrough in productivity and growth. It has happened many times before.

Our conversation ran the gamut from gut-wrenching to exuberant. Marking both ends of that spectrum, history is replete with examples of both natural and government induced cataclysms, and yet, human ingenuity has proven irrepressible in the face of it all. A favorite investor of mine, Josh Wolfe, is fond of saying, “failure comes from a failure to imagine failure.”

As mentioned above, I believe it is an important exercise to imagine a range of possibilities; however, more often than not, life and markets reside well within those extremes. The investing salve for this ever present uncertainty? Diversification.

In future posts, I’d like to dive deeper into these scenarios, the asset classes or strategies we can employ to navigate each of them, how these investments interact with each other, and in turn, how we can try to build greater robustness into portfolios.

Listen to our podcast here.

Return to Blog Page