Investing in AI

August 10, 2023 | By Kevin Smith, CFA

Marc Andreessen, perhaps the most influential venture capitalist, offers a simple definition of artificial intelligence: “The application of mathematics and software code to teach computers how to understand, synthesize, and generate knowledge in ways similar to how people do it.”

He recently wrote about why we should embrace AI rather than fear it.

ChatGPT is the earliest widespread evidence that AI is real, and it’s here to stay. The first couple of versions were like advanced auto-complete functions in a Word document, but the versions launched in early 2023 by Open AI are mind-blowing and creating seemingly limitless options to improve productivity. I keep a ChatGPT tab open on my browser constantly as a research assistant.

As investors, we wonder who will benefit from the AI boom? Where will returns flow from this amazing new technology?

We suspect the benefits will be widespread, impacting every corner of the market, so a simple answer is to be a diversified investor. That’s probably not the answer anyone is hoping for, but it’s a good place to start. Productivity drives growth, and growth drives corporate earnings, which drive stock prices.

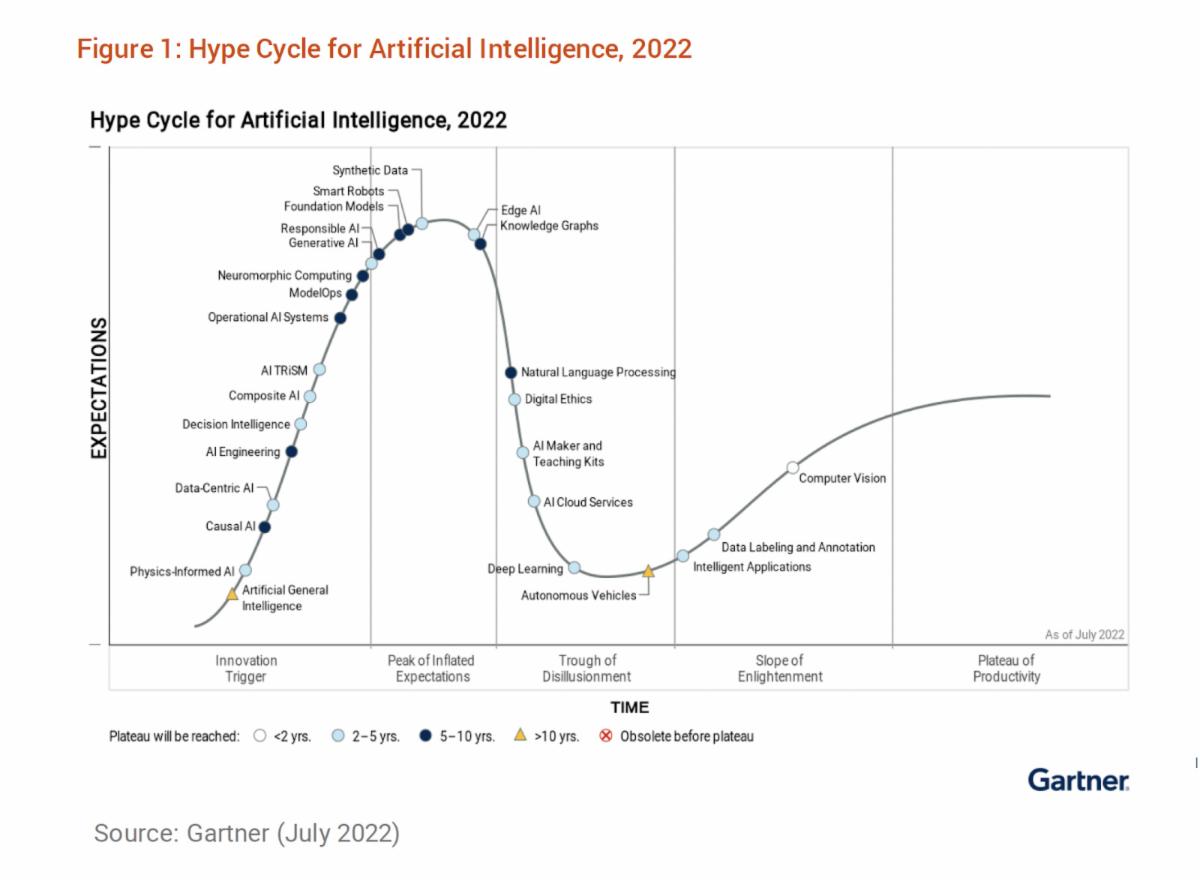

Exactly when these expected productivity benefits will kick in is difficult to anticipate, but we can use history as a guide. The consulting firm Gartner maintains what they call the hype cycle model for market segments (below) which seeks to represent how a technology or application will evolve over time. The idea is markets go through an emotional rollercoaster before broad adoption becomes part of our economy and culture.

An easy example of hype cycles is online shopping, which started with a frenzy of excitement and investment in the ’90s, followed by a major market crash. Nothing really worked like we hoped. During the ‘trough of disillusionment’ in the early 2000s, Amazon created an infrastructure that made modern e-commerce viable. (Made possible by their development of a massive cloud computing infrastructure – a subsequent technology boom.) But there was much suffering before the success.

The chart below shows the growth of a $10k investment at the inception of Amazon, and illustrates the extreme stock price implications of the hype cycle. It took over 10 years for the return on Amazon to recover from its peak before the Dot Com bust. Then it went hyperbolic.

Now, we are well into the ‘stage of enlightenment’ with online shopping and probably near the ‘plateau of productivity’. I suppose we are still waiting on same day drone delivery.

An example of a hype cycle that is still stuck in the ‘trough of disillusionment’ is probably 3D printing. Once the most exciting concept in manufacturing innovation, now we mostly see it in art studios, science museums, and university labs. No doubt there are bigger applications out there (building affordable housing), but its utility is currently far from original expectations.

Maybe the AI hype cycle will move faster. After all, AI is already making software engineers far more productive. That takes us back to the big question every investor wants to answer: who will be the big winners and how to invest in them?

AI tools are being built every day, benefiting specialized applications the most, such as graphic design, content creation, and editing. But we don’t have a ‘killer app’ that boosts productivity across the board… yet. Will there be one version that is clearly the best? Or will there be dozens or hundreds of specialized versions? Or both? You can be certain they are in development now.

Some of the big tech incumbents were positioned to benefit immediately. For example, Microsoft partnered with OpenAI, creator of ChatGPT, and is building AI tools into their widely used applications. Apple is positioned to create a mobile environment for AI applications. Nvidia builds processors used by the AI engines, and Adobe was well-positioned to deploy the graphic design superpowers of early AI applications.

In some cases, the early adopters maintain an advantage, but the level of competition is fierce, and sometimes new technology crushes incumbents. Does anyone remember Netscape? How about Kodak?

Broadly diversified index funds have a significant allocation to these leading tech companies already. It is tempting to chase after the returns of the current leaders, but remember the hype cycle! Some of those alluring returns will be fleeting.

Government regulators may attempt to change the playing field in an effort to protect the public against runaway AI risks, influencing who wins and who loses.

What about new entrants to the market – the big winners of the future? As with all startups, there will be many more who try than who succeed. Some investors will find access to early stage seed funding, but should consider it speculative and be prepared for that investment to go to zero. (Disclosure: I have made such an investment and accept that it may go to zero.)

There seems to be an abundance of venture capital funds circling AI startups, but there is probably more capital available than companies that will thrive. The best startups may be funded by the most powerful venture capital firms, who don’t need to raise money from the general public. We will see private equity funds create offerings that specialize in AI technology, and there will no doubt be some big winners, but investors should take a sober approach to the reality of the risk – failure is likely, particularly after considering the effects of high fees and lots of debt.

Startups that survive venture capital funding will eventually join the public markets in an IPO. Access to pre-IPO investments is very limited, and carry significant risk of being overpriced, so should also be considered speculative. Index funds that specialize in small and mid sized companies will be a low cost way to gain exposure to these companies and benefit from their success without having to be right about who will win. Many investors exclude small company stocks from their portfolios.

Investing in AI is one thing, but investing with AI is another. We have already seen investment funds launch using AI technology to generate investment recommendations. Can AI systems exploit the flaws in human investors? I think the large language models (LLMs) used by AI are well suited for measuring human sentiment, which can correlate to short term price movements. We are open minded about this and will monitor the market for emerging investing applications. But like any ground-breaking strategy, as money flows into that strategy, the outsized returns tend to come back to earth.

Here is a summary of how investors may benefit from AI advancements without having to pick winners and be right about timing the hype cycle:

- Big net – stock market indices will benefit from broad productivity gains from AI, both in the US and abroad

- Big tech – market-cap weighted indices that favor high momentum stocks will benefit if big tech companies capture significant AI gains

- Small tech – small cap equity funds may pick up the next generation of successful tech stocks, and the AI benefits that help small companies grow faster. Startup opportunities are hard to access, usually require a large investment, and have a high risk of failure.

- Surprises – AI could breath new life into stagnant companies that have not priced-in new growth potential. Value strategies are most likely to hold these.

Return to Blog Page