Markets and War

March 15, 2022 | By Kevin Smith, CFA

I’ve heard financial markets described as “expectations machines”, and I think that’s about right. Asset prices are based on what people are willing to pay for them, which is based on what they expect to receive in return. Prices go up when expectations are high. Prices fall when expectations are low.

The price of an individual company is driven by these same dynamics. If a company’s expected cash flows decline, so will the stock price.

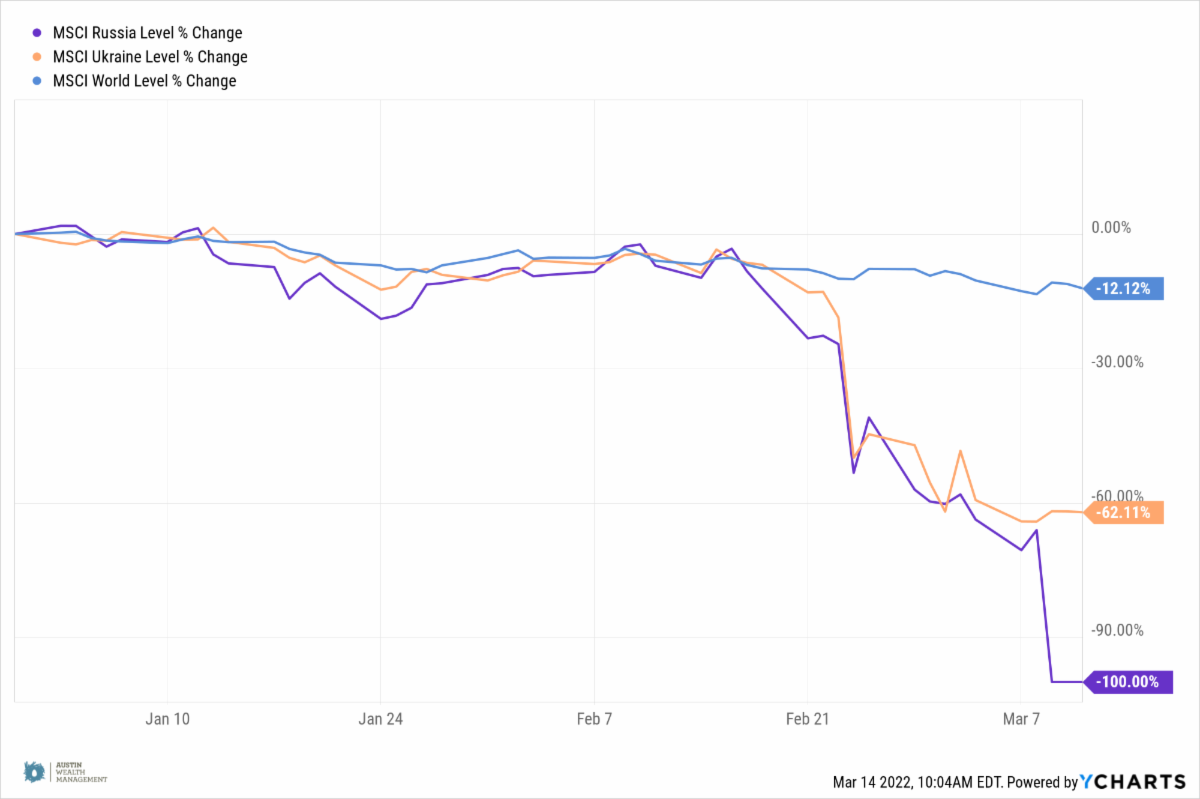

War has a massive impact on expectations, and the companies operating in countries directly involved in conflict are most impaired. They may lose access to supplies, labor, markets and financing. A country’s entire stock market can be wiped out, and may never recover. The value of Russia’s stock market has essentially been wiped out, and Ukraine has lost more than half of its value in the first weeks of conflict.

Prior to the conflict, Russia’s total stock market was less than 2% of the MSCI Emerging Markets Index and 0.4% of MSCI All Country World Index, so the direct financial impact on a globally diversified stock investor has not been significant.

But stock markets are not the only measure of a country’s economic value. Globally, Russia produces 10% of oil (3rd largest producer), 17% of natural gas, 11% of precious metals, 11% of wheat, and 10% of industrial metals. In combination, Ukraine, Belarus, and Russia produce 35% of potash (fertilizer), 24% of wheat, 13% of corn, and about 10% of global calories, globally. Those commodity markets are essentially offline right now. With expectations for the supply of those resources way down, prices shot way up.

General price inflation in the United States had increased dramatically before the Russia-Ukraine conflict. Those conditions still exist while this new commodity supply shortage pushes inflation expectations even higher, impacting global markets well beyond the loss of value in Russian stocks.

The economic impact of every conflict is unique, but we can learn from history. The S&P 500 has usually declined in the immediate reaction to geopolitical conflicts, and recovered rather quickly, most often within months. (Bloomberg’s Barry Ritholtz provides those details using data from LPL here.) Perhaps surprisingly, average annual returns on U.S. stocks have been positive, but also below the long-term average, during most prior major global conflicts:

- WWI +8%

- WWII +7%

- Korean War +16%

- Vietnam War +5%

It raises the question, “Why have returns been positive when the world was in such turmoil?”

If we look at markets through the lens of the “expectations machine”, the expected cash flows of most of the companies in most of the markets remained positive, on average, and the “market” is just a collection of many companies producing goods and services. The resilience of markets is driven by the ongoing participation of individuals working and consuming every day. As long as people are allowed to exchange with each other, markets should persist and assets should have value. When that is not the case, markets can, and have gone to zero.

History suggests investors should prepare for a period of below average returns from both stock and bond markets during a global conflict, which was already a concern because of low interest rates, historically high stock valuations, and trillions of new U.S. dollars in circulation.

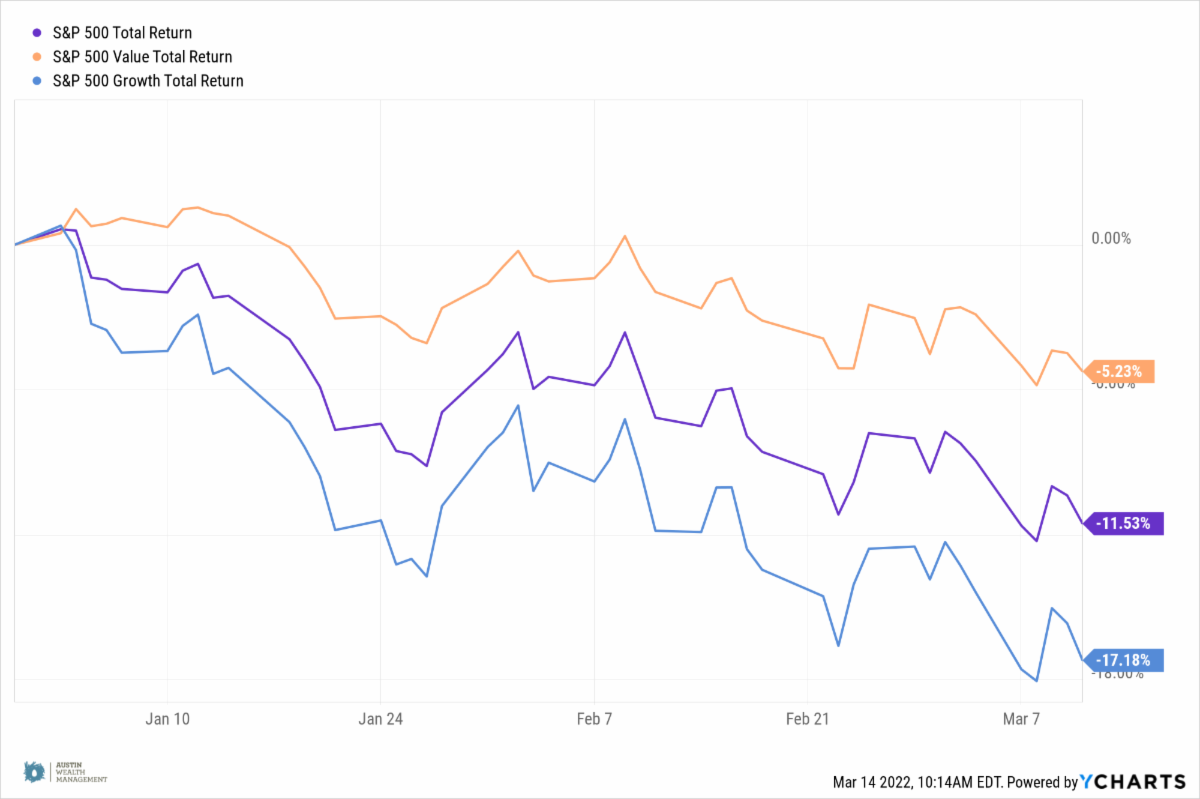

There have been some bright spots in markets. After 5+ years of under-performance during the raging bull market in U.S. stocks, our old friends “diversification” and “value” have made an appearance. “Value” strategies favor stocks with lower prices compared to earnings, sales, cash flow, or some metric of a company’s economic footprint. Value strategies have done relatively well compared to previously expensive “growth” stocks during the recent market decline.

The category of “alternative investment strategies” had been abandoned by many investors after more than a decade of terrible performance relative to traditional stocks and bonds. We are reminded of their potential impact as diversifiers during periods of market turmoil and price trend reversals.

Thus far in 2022, these are about the only investment strategies with positive year-to-date returns. Part of the challenge with staying invested in these strategies is the timing and size of their impact is unpredictable, and it often happens rapidly.

We can state with confidence that no single investing strategy works with any reliable consistency or predictability over short- and even medium-term time horizons. With the benefit of hindsight, we observe that decades of disciplined investing are needed to enjoy the compounding growth and diversification effects.

Geopolitical conflicts like Russia-Ukraine impact our perception of near-term investment risks, but our fundamental investment philosophy remains consistent, and we make our adjustments at the margins.

Here are some examples of expectations over different time frames and how we use investment tools to address them:

Short Term (1-3 years): Expecting lots of market volatility, high inflation; potentially higher interest rates. Strategy emphasis:

- Hold the right amount of cash, not too much

- For principal protection, favor shorter-term bonds, inflation-protected bonds

- Include alternative real assets for diversification and risk management

Medium Term (5-10 years): Expecting anemic returns from traditional stocks and bonds; possibly higher interest rates and income tax rates. Strategy emphasis:

- Favor high-quality bonds until riskier bonds provide higher yields

- Broad diversification of stocks, with a preference for relative value and quality

- Include alternative trading strategies for risk mitigation in extreme markets

- Tax efficient trading in non-qualified accounts

Long Term (10+ years): Expecting compound returns to approach historical averages. Strategy emphasis:

- Global diversification of stocks, with emphasis on markets with high growth expectations

- Emphasis on factors with higher expected returns: value, momentum, quality, yield

An important lesson re-learned from markets over the past few years is that no single asset or investing strategy is without risk. Cash is risky because of inflation. Bonds are risky because of interest rate sensitivity and inflation. Commodities are risky because of global supply chain interdependence. Real estate is sensitive to interest rates and massive financial leverage. Stocks are risky for all of those reasons and more, and cryptocurrency hasn’t been the antidote to inflation.

There is no risk-free investment. There is only risk management. Our most reliable risk management tools remain a focus on diversification and value.

– Kevin X. Smith, CFA

Return to Blog Page