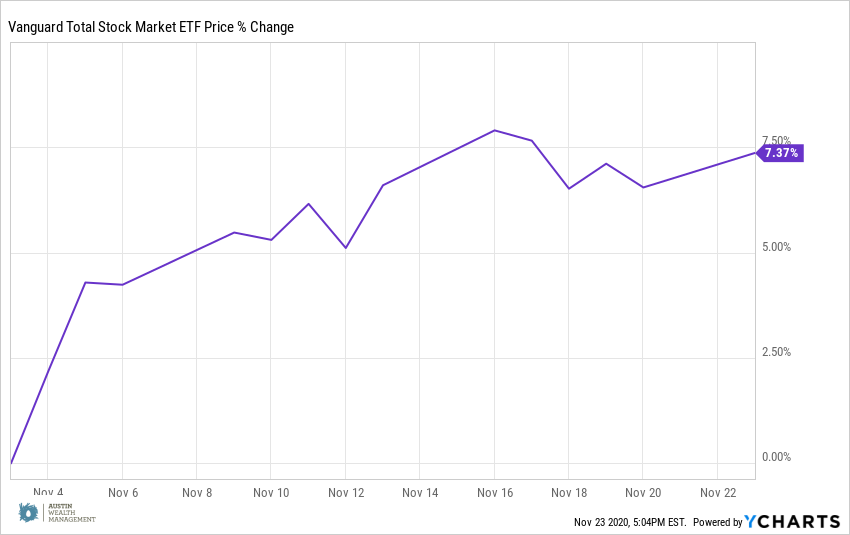

Post-Election Market Surprise

November 25, 2020 | By Kevin Smith, CFA

How did the stock market do after election day? Remarkably similar to four years ago.

2020 Post-Election Global Stock Index

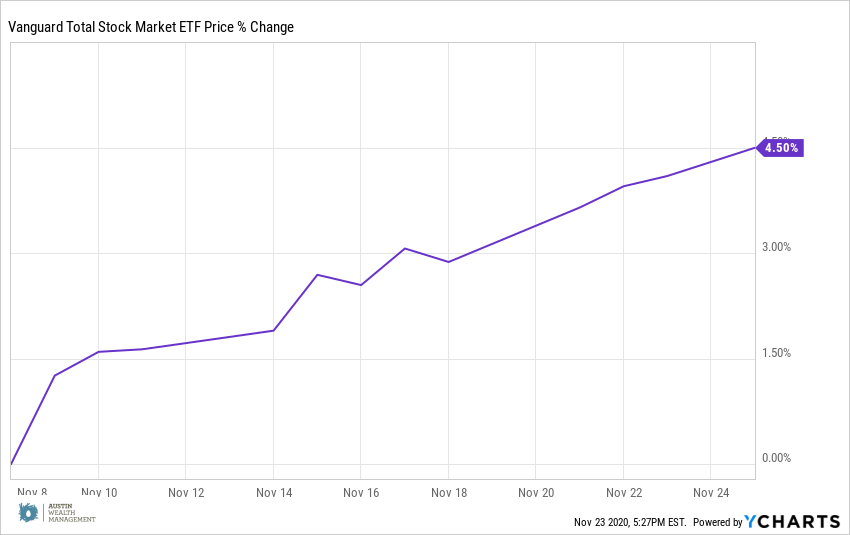

2016 Post-Election Global Stock Index

If you predicted Joe Biden would win a contested election with a (possibly) split Congress and stock markets would rally, you may be among the few who nailed it. The consensus views of professional strategists before the election were quite different.

Many professionals seemed to think a Democrat president and a split Congress would be bad for stock markets, but for a different reason than usual. This time the major concern was a split Congress not being able to generate sufficient stimulus (money printing) to keep the recovery going. The more historically typical Wall Street concern was Joe Biden’s proposed tax increases and business regulations being bad for growth. These arguments are at least rational, even in hindsight, but the broad acceptance of a Biden victory coincided with a significant market increase, to the surprise of many.

The updated explanation I hear most often is a political log jam means not much will change, so businesses and markets can continue with less uncertainty. In the 20 years I have been studying markets, the only time certainty seemed palpable was the months leading up to the dotcom bubble bursting. That feeling of certainty can be better described as irrational exuberance. In markets, risk is ever present and certainty does not exist.

Certainty cannot describe the prevailing outlook of a Trump presidency at the time of his 2016 election. Even the staunchest supporters, although optimistic, would have to admit they could not predict what the new president would do in office. Perhaps the expectation of lower taxes and business friendly policy was more influential than the increased uncertainty. Whatever the explanation could be, the chart above shows a very similar post-election stock market increase under very different circumstances.

Simple narratives are only useful in making us feel like we understand why stock prices move up and down. But most narratives are not predictive, and when they are not, humans have a way of re-framing them so we don’t feel so silly. We will always be attracted to simple stories relating current events, but would be better served by the more durable stories about the links between risk, rewards, time, diversification, and discipline.

History does not indicate a clear correlation between political party control and market performance. Investors cannot accurately anticipate the direction of markets based on election results, let alone the magnitude. Making small bets about these things probably won’t hurt, but those who stay committed to a long term strategy are less likely to make costly mistakes and more likely to compound their wealth with market growth over time.

Posted in: Investing

Return to Blog Page