Qualified Charitable Distribution: Philanthropic Impact Meets Tax Savings

January 2, 2024 | By David Lowe, CFP®

Good news: Through hard work, savings and diligent investing, you retired with $1 million or more in pre-tax IRA funds!

Bad news: The government wants its piece of the pie and starts taxing your IRAs in your 70s.

Now back to good news: If you support charitable causes, you can do that while also limiting the tax hit to your IRAs. This often-overlooked strategy is called a Qualified Charitable Distribution, or QCD. Depending on your financial situation, this could be a valuable strategy to consider for 2024.

First, some background on one of the problems a QCD can solve. This relates to Required Minimum Distributions – or RMDs – from your pre-tax IRAs.

RMDs and your taxes

Starting in your 70s, the government requires you to withdraw money from your IRAs. The exact timing of required withdrawals depends on the year you were born. Here’s a quick summary:

- Born in 1950 or earlier: your RMDs are already in effect

- Born in 1951-1959: your RMDs begin the year you turn 73

- Born in 1960 or later: RMDs will start when you turn 75 (based on current law – unless Congress changes the rules again, as it did with the SECURE 2.0 Act).

Mandatory withdrawals continue each year for the rest of your life, even if you don’t need the money to cover living expenses. The exact withdrawal amount is recalculated each year. The IRS calculates your RMD amount based on your account balance (on the preceding Dec. 31) divided by a life expectancy factor. Check out this handy online RMD calculator.

Why does all of this matter? Income taxes.

With a pre-tax IRA – such as a rollover account that received your 401(k) funds when you retired – you can defer taxes until RMDs begin. That’s a good deal until your early 70s. Once RMDs start, though, the tax deferral party is over!

Any amount you withdraw as an RMD is taxed as ordinary income. If you are a high-income retiree (due to a generous pension, dividends, interest or capital gains), additional income in the form of an RMD only adds to the tax problem. That’s particularly true if your other income already covers your expenses and you don’t really need the RMD.

If your inflows place you in a fairly high marginal tax bracket, any additional income (in the form of RMDs) can be taxed at 24% or more – potentially up to 37%. That’s a big hit, especially after you worked so hard to save money into your IRA.

On the other hand, if you enjoy giving to charity, a Qualified Charitable Distribution can help you help others, while also limiting your tax bill.

Here’s how it works. The government lets you give part or all of your RMD as a distribution directly from your IRA to charity. That gift does not count as income on your tax return. Plus, you still get to take the standard deduction (which reduces your taxable income).

Sample scenarios for QCDs

Consider the math for a hypothetical married couple who give to charity. Assume the following for the 2023 tax year:

- Each spouse is 75.

- Each spouse had a pre-tax IRA balance of about $1 million at the end of the previous year.

- That means each spouse would be required to distribute roughly $40,000 from the IRA. If the distribution is a regular RMD, that money counts as income. If the distribution is taken as a QCD, it doesn’t count as income.

- The couple’s other income sources for 2023:

- $100,000 in pensions ($50,000 for each spouse)

- $80,000 in Social Security benefits

- $25,000 in qualified dividends

- $10,000 in non-qualified dividends

- $20,000 in taxable interest

- $20,000 in long-term capital gains

- Miscellaneous assumptions:

- The house is paid off, so there’s no tax deduction to take for mortgage interest.

- The couple lives in Texas (no state income tax) and pays $15,000 in property taxes. Remember, though, that the federal tax deduction for state and local taxes (SALT) is capped at $10,000.

- Except for charitable contributions and SALT, the couple has no other potential itemized deductions. Assume, for example, that medical expenses are fairly low.

Based on those numbers, the couple would fall within the 22% marginal tax bracket (once tax deductions for charitable giving are factored in). Let’s look at two different scenarios to see how the couple’s charitable giving strategy affects income taxes. We’ll focus on four key metrics:

- Modified Adjusted Gross Income

- Note: MAGI is important because of how it affects Medicare premiums. We’ll have more details on that in a minute.

- Total tax deductions

- Taxable income

- Total tax bill

Scenario 1 – no QCD; $80k cash contribution to charity

- Each spouse takes the full $40,000 RMD – for a total of $80,000 of taxable income related to the IRA distributions.

- Then, the couple writes an $80,000 check to a favorite charity.

Here are the couple’s key tax metrics for this scenario:

- MAGI: $323,000

- Total tax deductions: $90,000

- Taxable income: $232,898

- Total tax bill: $41,332

Scenario 2 – with full QCDs

- Instead of taking an RMD and then writing a check to a charity, each spouse gives $40,000 directly from the IRA to a charity (as a Qualified Charitable Distribution).

- Since the couple gives a total of $80,000 to charity through QCDs, the couple does not make additional charitable contributions for the year.

- The other assumptions are the same as in Scenario 1.

Note how this scenario’s key tax metrics compare to those in the no-QCD scenario:

- MAGI: $243,000 ($80,000 lower)

- Total tax deductions: $30,700

- Yes, this is a lower deduction amount than in Scenario 1. One trade-off when making a QCDs is that the charitable contribution cannot also count as an itemized deduction. (That would be double counting.) However, because charitable IRA distributions were excluded from income from the start of the tax calculation process, this couple still comes out ahead. Need proof? Look at their next two key tax metrics.

- Taxable income: $212,198 ($20,700 lower than in the no-QCD scenario)

- Total tax bill: $34,004 ($7,328 lower than in the no-QCD scenario)

Arguably the biggest takeaway from these hypothetical scenarios is the potential to lower the overall tax bill. Think of what these retirees could enjoy with the more than $7,000 they could save through QCDs. That money could mean a special gift for each spouse, contributions to grandkids’ college accounts, or maybe an anniversary cruise!

Want to see another example? Here is a handy comparison from Schwab of a QCD versus a cash donation.

How QCDs can reduce Medicare premiums

Beyond income tax savings, there is another potential benefit to QCDs. Depending on the individual’s or couple’s income level, a QCD could reduce the monthly Medicare premium.

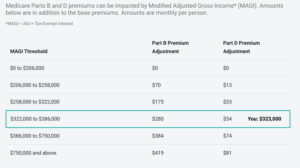

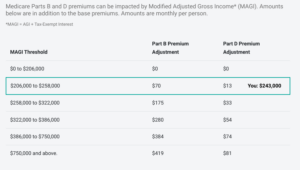

For taxpayers who have income above specific MAGI levels, the government charges additional premiums for Medicare Part B (medical) and Part D (prescription drug) coverage. This fee is deducted from monthly Social Security benefits. The government charges this “income-related monthly adjustment amount” – often called IRMAA for short – based on income from two years prior. Income in the 2023 tax year, for example, will affect the premium paid in calendar year 2025.

This site shows the IRMAA brackets for 2023 and 2024 (based on income reported in 2021 and 2022, respectively).

In some cases, a QCD could reduce income enough to drop a taxpayer to a lower IRMAA bracket. That could reduce the taxpayer’s IRMAA surcharge, allowing the taxpayer to keep more of his or her monthly Social Security check.

In the no-QCD scenario above, for example, the couple would fall in the third-highest IRMAA bracket. As a result, each spouse would owe a monthly IRMAA surcharge of $280 for Part B and $54 for Part D.

In the QCD scenario, however, the lower MAGI allows the couple to drop not just one but two IRMAA brackets lower.

Dropping to a lower bracket would save each spouse $210 per month on the Part B surcharge ($280-$70) and $41 per month on the Part D surcharge ($54-$13). Multiply that $251-per-month savings by 12 months and by two spouses, and that yields an annual savings of more than $6,000 in Medicare premiums for the household! That’s in addition to the more than $7,000 the couple could save in income taxes through the QCD strategy. Wow – a total of more than $13,000 in savings for the year!

Depending on an individual’s or couple’s financial situation, reducing gross income through a QCD can have other beneficial tax effects. Those can include Net Investment Income Tax savings or, in some cases, reduced taxes on Social Security benefits.

QCD Logistics

Even if RMDs don’t start until age 73 or later, a person may make a QCD upon reaching age 70.5. For those who regularly give to charity, it can be a good idea to make QCDs before IRA distributions are mandatory.

For one thing, this reduces the strain on cash flow. You were going to donate anyway; now it’s just a matter of picking the funding source. If charitable contributions come out of IRAs, that means less money must come out of a checking account, brokerage account, etc. to fund the donations.

In addition, starting QCDs as early as possible can reduce the size of a pre-tax IRA (or at least limit the account’s growth from age 70.5 to RMD age). This means the future RMD amount will be smaller, so there will be less of a tax problem to manage.

A QCD used to be limited to $100,000 per taxpayer per year. Because of the SECURE 2.0 Act, however, the maximum QCD amount will increase over time based on inflation. For 2024, the maximum QCD is $105,000 per person.

A QCD can go to a variety of charitable recipients, including churches, synagogues, educational nonprofits or other 501(c)(3) organizations. A QCD cannot go to a Donor Advised Fund or a private foundation, however.

You can give the QCD as one lump sum – as early as January, or later in the year if you prefer. Or, you may distribute the QCD in a series of transactions, with gifts to one or more charitable organizations. One caution: by default, the first dollar withdrawn from an IRA is considered to be an RMD. This can cause trouble if you first take a regular RMD (i.e. a distribution to your checking account) and then want to think about a QCD later. So, if you take only part of your RMD as a charitable distribution and plan to spend the rest of the RMD, make sure to take the QCD first!

The timing – as well as the logistics of documenting the QCD – can be a little complex, so please plan carefully with your financial advisor and CPA. If you file your own taxes, check out this IRS guidance about how to report a QCD.

As with other charitable contributions, be sure to get a receipt that lists:

- the date of the contribution

- the amount of the contribution

- a statement that you did not receive anything of value in exchange for the contribution.

- For details, see this IRS guidance about reporting a charitable contribution.

If you work with a financial planner and CPA, make sure your whole team knows you executed the QCD strategy. A good tax preparer will know how to document things correctly – but that only works if your team communicates well. Otherwise, the CPA might not be aware that you used the QCD strategy!

A QCD may not be ideal in every situation. However, if charity is one of your key values and you also have a large pre-tax IRA balance, it can be a great strategy to discuss with your financial advisor. Under the right circumstances, a QCD can accomplish two important goals at once: supporting a philanthropic cause and reducing taxes.

Return to Blog Page