Recession Risk by Life Stages

April 23, 2020 | By Kevin Smith, CFA

Early to Mid Career

Income risk

Younger executives and professionals in the process of establishing careers may be at higher risk of income loss, which can come in the form of reduced base pay, lower bonuses or layoffs.

- 30% rule – always maintain a 30% safety buffer as a percent of your gross (before tax) income. This means that you could quickly cut back your savings and unnecessary expenses by 30% to absorb a prolonged reduction in income. If your gross household income was $200k, could you reduce your overall outflows by $60k? For example: reducing investment contributions, travel budgets, memberships, services, and discretionary spending. If the answer is no, your fixed costs may be too high.

Solvency (default) risk

Income risk leads to solvency risk, or the ability to make debt payments. It is easy to become complacent about this risk in good times, but it can become a harsh reality without much warning.

- Cash reserves – always keeping enough cash to pay your expenses for 3 to 6 months

- Liquid investments – having access to low risk non-retirement investments as a backup to cash

- Debt restructuring – refinancing for favorable terms when possible, including student loan options

- Federal and state programs – being aware of benefits made available during crises

Late Career

The risks above often apply to this group as well, but their timeline and priorities are changing as kids grow up and the traditional retirement age is within sight.

Investment growth risk

Having seen their accounts recently decline by 20% or more, the possibility of not having enough assets at retirement becomes a growing concern.

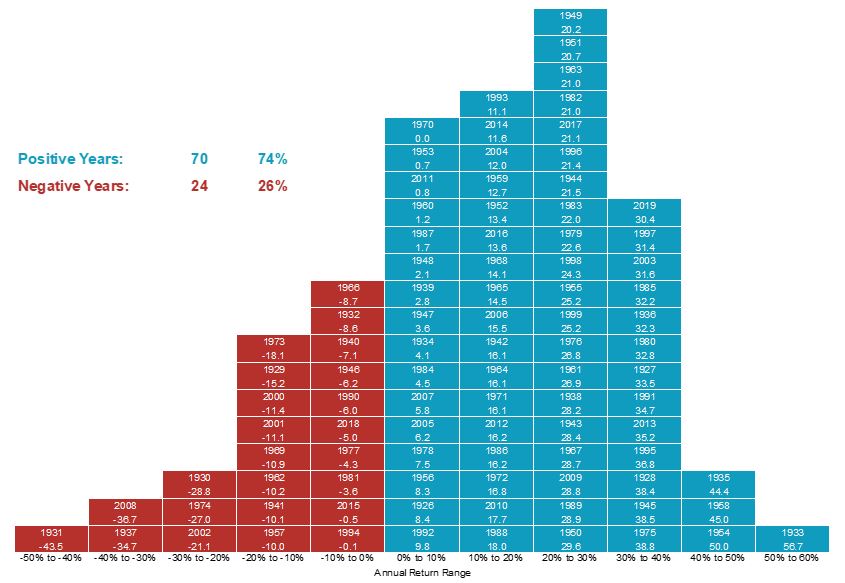

- Remember: bad years are in the plan. The chart to the right shows all of the calendar year returns in the US stock market. The red blocks are negative years, and they are a part of the long term average return of 8-10%.

- Owning enough stocks – our expected average return for cash is 1%, for bonds is 3-4%, and for stocks is about 6-10%. However tempting it may be to reduce stock market exposure now, it is not likely possible to achieve the required long term return without a meaningful allocation to diversified stocks.

- Daring to be different – achieving better than average returns requires investing differently from others. This can be as simple as maintaining some exposure to the currently ‘unloved’ types of investments.

College funding

With income expectations lower, investments in decline, and college prices rising rapidly, anyone with high schoolers today is thinking hard about how to handle this.

- Sharing the risk – Few 18 year-olds have an appreciation for these economics. If your are going to spend over $100k on college, you probably want your child to be motivated to make the most of it. There are a variety of ways to do this. For example, you might commit to covering some fixed amount of expenses, say tuition and board for a four year in-state public school. If they want to go to a private school, they will be on the hook for the additional cost (by way of a loan), but you might agree to help them pay it off if they complete their education and launch a career. Again, this is just an example to create alignment of interest and risk. There are many possible versions of this concept.

Retirees

Medical risk

Retirees are at greater medical risk in general, but even more so because of COVID-19.

- Medicare Supplements – if you are not confident in your selection of supplemental insurance packages, please let us know and we will provide support.

- Long Term Care – the managed care benefits of long term care insurance can help make sure proper care is provided while loved ones may be isolated, and the policy shifts financial risk to the insurance company.

- Powers of Attorney – these are legal documents naming trusted people to provide medical instructions and financial instructions. They should be prepared well before they are needed.

- Liquid investments – as medical technology improves at a rapid pace, some therapies may be available in the world that are not covered by our insurance plan. Having some investments set aside for this possibility may be increasingly wise.

Investment loss risk

The recent market decline impacted bonds as well as stocks, something that has rarely happened. Investors sold all assets at an incredible pace in the early weeks of the outbreak, pushing down the prices of even the safest of bond investments. Those bonds have since recovered most of their value, but it serves as a reminder that retirees should also maintain a cash reserve to cover at least 3 to 6 months of living expenses.

Inflation risk

Some economists argue we are facing deflation, others claim inflation is more likely. In either event, the risk remains, and it is too late to buy inflation-friendly assets after inflation has taken off. We have enjoyed average annual inflation below 2% per year for so long that inflation is rarely discussed as a legitimate risk, but it can be devastating to a retiree on a fixed income. We encourage our clients to maintain exposure to investments that tend to do better in high inflation, including inflation protected bonds, real estate, commodities, and stocks with different currency exposure.

Return to Blog Page