Risk Level is SOOOO Important

February 5, 2019 | By Kevin Smith, CFA

The amount of investment risk you take will probably make the biggest difference in how your account performs over short and long periods of time. It deserves our attention more than almost any other topic.

The two competing investment objectives at play are “I don’t want to lose money” and “I need to make money”. Bonds serve the former and stocks serve the latter. The best way we know to satisfy both objectives is to strike a proper balance between bonds and stocks, and use financial planning to allow all investments enough time to be successful.

Stocks are far riskier than bonds, but they have a lot more upside potential. A simple way to describe investment risk is the proportion of stocks compared to bonds in a portfolio. A portfolio with 60% stocks and 40% bonds can be described as 60/40 in shorthand. To further simplify, let’s assume all risky investments go in the ‘stocks’ category, like real estate and alternative strategies.

Ready for a surprise fact? Riskier portfolios are actually LESS risky in the very long run! Meaning the downside performance over 20 year periods has been better for risky portfolios compared to conservative portfolios. That makes a strong case for very long term investors to take a high level of risk, and if we were all robots designed to optimize decisions only using historical data, we probably would take more risk than we are comfortable with.

But we are not robots! We have emotions, biases and hopes of being able to predict what comes next. None of us are immune. The price we must pay for potential higher returns in the long run is an emotional roller coaster every six months. (Our brains seem to be wired to care far more about what happened in the last six months than anything prior.) Adding bonds to a portfolio has reduced the lows that cause distress, while reducing the highs that build wealth. What is the proper balance?

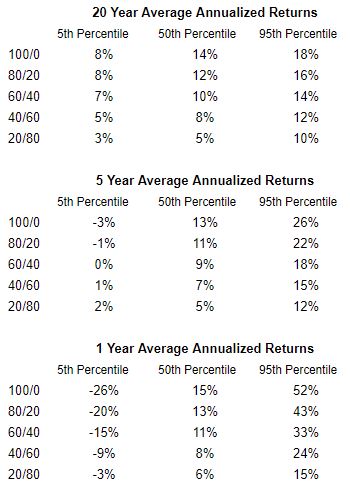

Let’s look at the numbers. The tables below are estimated historical average annual returns from globally diversified portfolios measured every month since 1927. The “5th Percentile” means that outcomes were lower than that number 5% of that time, the “95th Percentile” means outcomes were higher than that number 5% of the time. For example, only 5% of males are over 6’1″ tall and only 5% are below 5’5″. The “50th Percentile” is right in the middle, with most outcomes being close to this number. To extend the analogy, the 50th percentile for men’s height is 5’9″.

To illustrate the relationship between time, risk and return, we provide measurements of 20 year periods, 5 year periods and 1 year periods. Keep in mind that the only change between the portfolios (100/0, 80/20, etc) is the proportion of stocks to bonds. Each 20% incremental change in this proportion has produced about a 2% per year difference in 50th percentile returns.

Notice the big difference in 50th Percentile returns between 100/0 and 20/80 portfolios. Notice the massive differences between 5th and 95th Percentile returns in all time frames, particularly 1 Year periods. This tells us something about the kind of experiences we must be prepared for as investors, and the amount of time we must commit to investing in order to increase the chances of an attractive result.

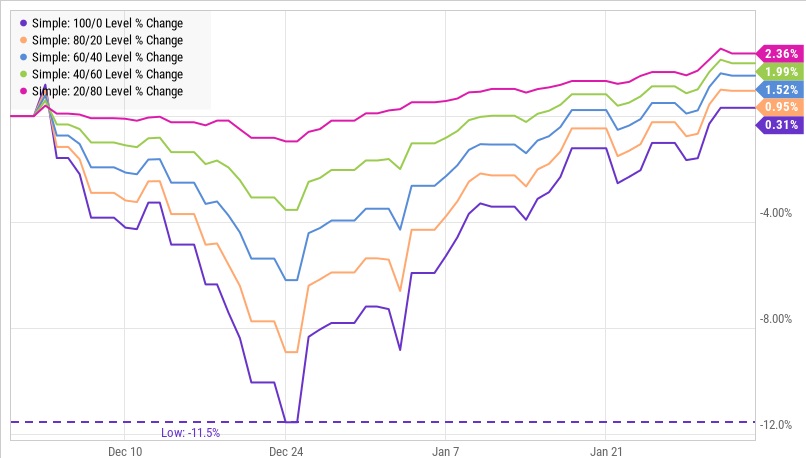

Let’s make it feel more real. This chart shows the investor experience across these portfolios during the wild stock market correction of Christmas 2018. The price we pay for higher expected returns is the possibility of painful declines. We cannot escape this reality.

How much risk should you take. Which portfolio is right for you? It mainly depends on three factors.

1) When do you need the money?

If you plan on withdrawing money from your portfolio in the next five years, you will probably want to shelter all or part of those funds from the volatile stock market. This will reduce the risk of having to sell stocks at a loss.

2) How does risk make you feel?

Let’s pretend the answer to 1) leads you to an 80/20 portfolio. If a decline in value of -20% over one year would cause you massive anxiety, to the point where you would be likely to sell out of stocks at a very bad time, you should probably take less risk if you can.

3) What return on investment do you need?

Your financial plan may require a minimum rate of return to achieve your objectives. For example, if that means you need 10%/year over the next 20 years, you may have to use a portfolio with 80% stocks to provide a good chance of making that happen.

Reconciling the trade-offs between your answers to these questions is some of the most important work you will do as an investor.

Return to Blog Page