Snipping Sneaky Subscriptions

June 28, 2021 | By Kevin Smith, CFA

I used to be really cheap. From the time I went to college until my early 30s, I actively avoided nice things. I bought house brand groceries, almost never bought new clothes, never paid for a hotel room, rented out every spare room in my house, and of course consumed only cheap beer. My dad was an accountant, so that may have had some influence, but I was generally happy living a modest existence and saved over 50% of my paycheck for years, which allowed me to start a business at age 27. As I walked out the door of my employer’s office, one of the bits of parting wisdom my boss and mentor shared with me was “X-Man (nickname), being a cheap-o will be a limiting factor in your life.” That was an eye opener. It changed my mentality and I still think about it often.

Letting go of my cheap self allowed me to be more generous with friends, invest in people and take financial risks to grow my business. I started calculating costs in terms of time and gradually became comfortable paying for services to get time back (I still cut my own lawn), but I recently realized that I went too far!

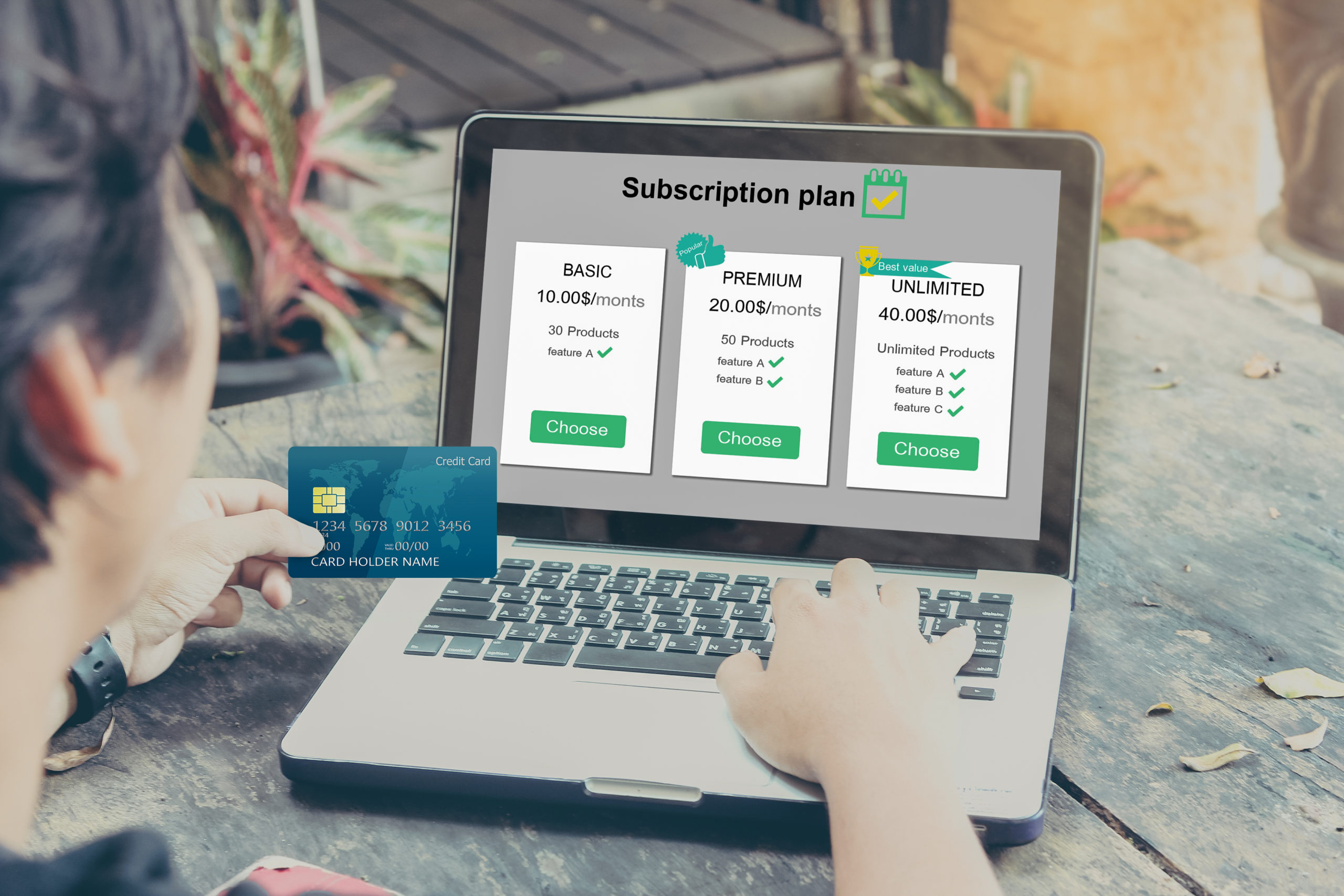

The explosion of e-commerce led to a popular subscription model for products and services. It is a GREAT business model for the provider because re-occurring revenue is consistent and scaleable. It makes the consumer feel like they have a meaningful relationship with a company they admire, and it is always framed as a great deal with super-convenient delivery. It can be a win-win, and often is, but it is easy to accumulate many subscriptions over time and never re-evaluate them. I discovered and cancelled 12 subscriptions totaling over $250 per month!

I like all of these products, but I concluded that I don’t need a subscription to enjoy these types of things. Some of them I just forgot about. Here are some examples:

- Norton Antivirus – I don’t even use PCs anymore!

- Whoop! – heart rate data is really helpful, but I could just buy a device without a subscription to get it.

- Coffee Club – I received another coffee club as a gift, so it was an easy cancel.

- BitsBox – a great product for teaching kids to code, but keeping up with it each month isn’t happening.

- Online Piano Lessons – the kids love it for a week, then forget about it, then I get the annual bill.

- Pure Vitamin Club – miss a few days here and there and end up with a vitamin surplus very quickly.

- Audible.com – I love audio books, but I also love podcasts and reading in general. I should just buy audio books one at a time.

- MudWtr – maybe I drink too much coffee, so I tried this as a substitute. I kind of like it, but don’t drink enough to keep up with a subscription.

- Starz! – we did the 14 day free trial to watch one show and forgot to cancel (ugh).

- Car wash – I bought this subscription during Covid to help them survive, but I really should pay per car wash.

To avoid systematically wasting money every month, I developed a way to evaluate if a subscription is worth while:

- Can I just buy this stuff when I run out? Like with almost any other product!

- Is there a non-subscription alternative? It may be worth it to pay a little more up front.

- How will I feel when I receive my 15th shipment of this thing?

- What will I do if I don’t receive this product monthly or have ongoing access to this service? The answer is often ‘nothing’ or ‘add it to the grocery list’.

- If it’s not easy to cancel, don’t sign up. It was excruciating to cancel the Wall Street Journal and The Economist. “Yes, I am sure I want to cancel. Thank you, but yes, I still want to cancel”.

There are definitely subscription products and services that make a lot of sense. I am happy to subscribe to critical software programs that I rely on and update constantly. I am happy to pay for professional consultative relationships, both business and personal. I am happy to pay for services that directly save time, like house cleaning. I really should hire someone to cut the grass (but I kind of like it).

I remain convinced that being a cheap-o is a limiting factor in life, but I invite my cheap self to take a look over my shoulder every once in a while to make sure we aren’t getting carried away. Review your subscriptions with an open mind and you might be surprised by how much money you will save and how little it will effect your happiness.

Return to Blog Page