T-Bill & Chill

January 17, 2024 | By Kevin Smith, CFA

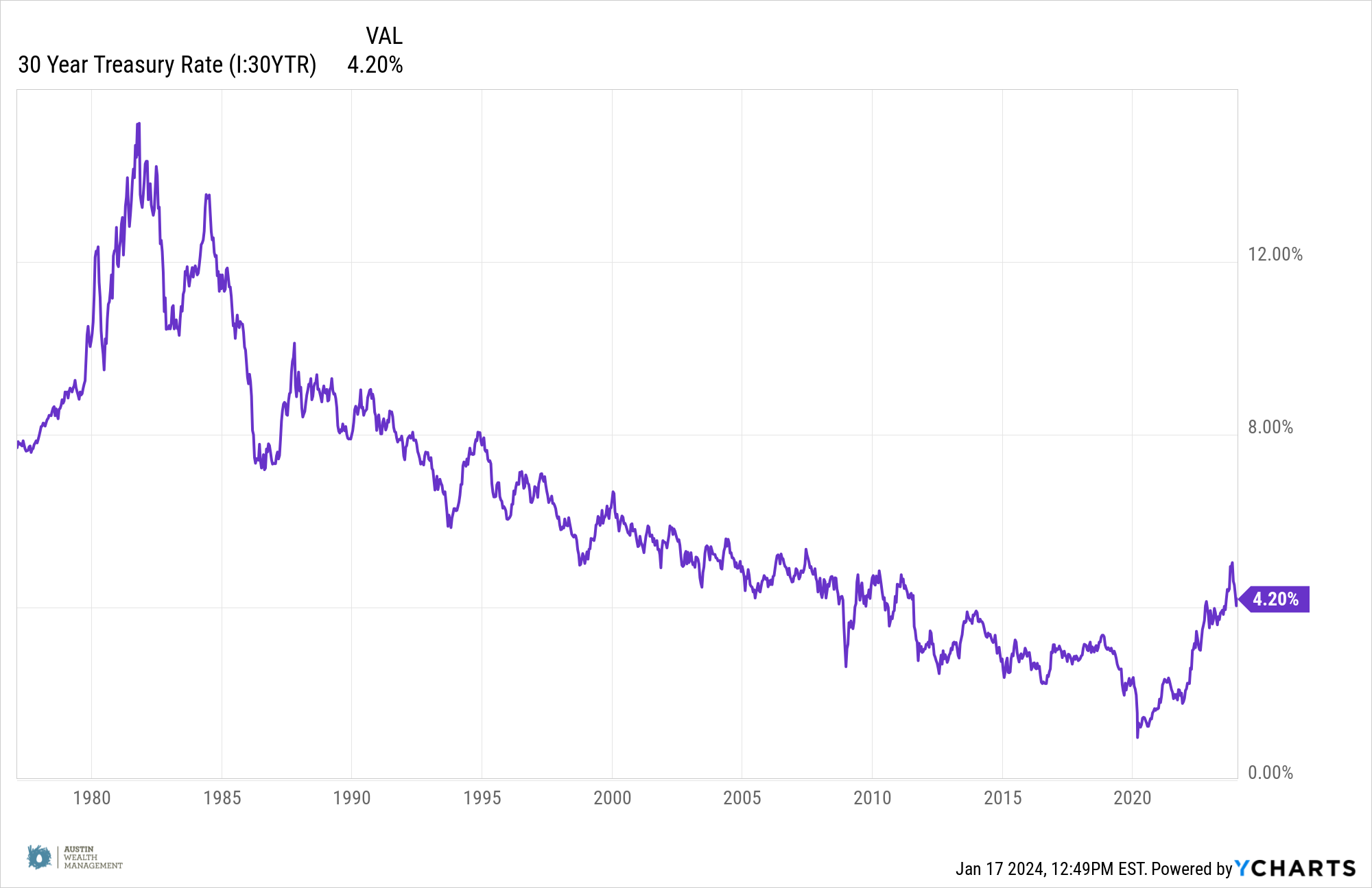

Hop in the time machine with me. You could have bought a 30 year Treasury Bond in 1981 yielding 15% annual income! That income was backed by the taxing authority of the United States Treasury, so it was pretty safe.

A $2,000,000 investment in that bond would receive $300,000 per year for 30 years… with basically no risk. You would even get the $2M back at the end of 30 years!

With that retirement plan, you could take your Social Security, cancel your Wall Street Journal and cable news subscriptions, and sail off into the sunset. That would truly be ‘living off the interest’. And the biggest risk of that strategy lurking in the background would be high inflation driving up the cost of living.

That was the 1981 version of our newly minted “T-Bill & Chill” social meme, which suggests just putting your money in Treasury Bills, collecting an attractive fixed rate of interest, and forgetting about it.

Our 1981 counterparts would not have gotten the reference because they (we) were suffering scheduled TV programming long before Netflix arrived.

While the 2023 version of this plan is not nearly as compelling at 5% income yields instead of 15%, it is getting more interesting.

For most investors, a 5% rate of return is not enough to satisfy their long term financial objectives. One reason is those future goals are expensive and require substantial growth to achieve. Another reason is inflation makes those objectives even more expensive over time.

We use the ‘real return’ measurement to put this in perspective. That is the nominal (before inflation) return minus the rate of inflation. So if your T-Bill pays 5% and inflation is 5%, your real return is zero.

In other words, a zero real return means you are able to purchase the same amount of stuff with your money, not more stuff, which is the goal.

After years of interest rates on cash and bonds under 3%, a 5% interest rate on ‘safe money’ is understandably compelling, but the question is how long can you chill with the T-Bill & Chill approach?

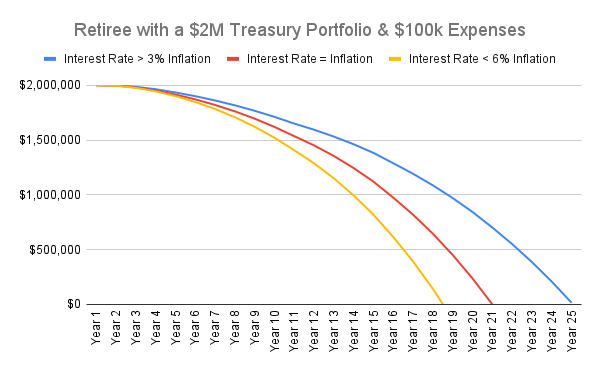

We ran examples of a $2M portfolio with $100k annual withdrawal needs, invested using current Treasury rates in different inflationary environments. If you are a numbers person, you might like this analysis.

The short version (TLDR) for retirees: your interest rate on Treasury Bills needs to exceed the rate of inflation for this model to last more than 20 years, and the interest rate needs to exceed inflation by at least 4% for the portfolio value to grow over the full period, net of withdrawals.

The current Treasury Bond rates probably aren’t going to cut it.

Accumulators (investors who haven’t retired yet) aren’t as obviously impacted, because they will reinvest the interest and their portfolios will steadily grow.

Unfortunately, the purchasing power of their interest income will erode unless the inflation rate stays below the rate of interest by at least 1% or 2% per year. Depending on their objectives, a 2% real rate of return probably isn’t enough.

Investors can ‘lock in’ the Treasury Bill rates by buying these bonds, but we can’t know what inflation rates will actually be. Inflation has averaged 3.2% per year since 1914, but it averaged about 8% in the 70s, touched 9% in 2022, and averaged about 6% from 2020 through 2023.

So how long can you chill with your T-Bills? You could sit out of the markets for the next year and collect 5% interest, and as long as inflation grows at only 3%, you’ll have yourself a solid 2% real rate of return.

Then what? Your T-Bill matured and the new interest rates and inflation rates next year are anyone’s guess.

If you try to lock up your Treasury interest for longer, you will have to accept a lower rate. The 10 Year Treasury bond pays closer to 4%, and if interest rates increase further during the 10 years, your bond will become worth significantly less than you started with if you need to sell it early. That’s not my idea of chilling.

TIPS are a little more interesting. These are Inflation Protected Securities and are priced to provide you a ‘real return’ of almost 2.5%. Remember that means your return AFTER inflation. You get that return even if inflation is higher. Now we are getting somewhere.

What about corporate bonds? Lending money to a business adds the risk of not getting paid back. That’s called credit risk. Many corporate bonds are now selling for 90 cents on the dollar or cheaper after the recent rise of interest rates, and they might be paying 6% or more in interest to compensate you for the credit risk.

When you add the discount together with the interest rate, you get the ‘yield to maturity’ of 7% to over 10%, depending on the level of credit risk. That is the return you could get if you buy the bond, hold it until it matures, and the company stays in business and pays you. If inflation is average, that could be a 4-6% real return.

Investors can take advantage of these more attractive bond returns that have come with higher interest rates, but both retirees and accumulators will likely need to continue owning risky assets with higher potential real returns, like corporate bonds, stocks and real estate.

Few will actually be able to T-Bill and Chill. It’s not 1981!

Return to Blog Page