The Language of Loss

August 4, 2022 | By Kevin Smith, CFA

If you bet against the Golden State Warriors basketball team, and you watched their star, Steph Curry, make a game winning shot, it may have felt like you were losing money from the time the ball left his hand until it splashed through the net for the game winning point. After all, he’s the best shooter ever and he makes it almost half the time. But until the shot went in, you really only had the potential to lose money. On the flip side, you weren’t making money when your team was winning during the game, you only had the potential to make money. The making or losing of money happens as probabilities collapse to 0% for a loss or 100% for a win, all in a moment. In basketball, that point in time is the final buzzer. With investing, it’s when you sell and spend the money.

During times of stock market turmoil, we often hear the phrase “my stocks are going down” or questions like “should we sell the ones that are going down?”. We understand what everyone means by that, but those are logically incorrect ways of speaking, and it matters. Those phrases are hints that the investor’s thought process may be flawed, which can lead to costly mistakes.

There is no ‘going down’, there is only ‘has gone down’. This may seem like quibbling over words, but these words imply important meaning. We can only describe what has happened in the past, and make an educated guess about what might happen in the future. Using the active, present term ‘going’ implies we know something about what will happen next with the certainty of a car rolling down a hill in neutral without breaks. Using the phrase ‘going down’ carries the message that the stock price movement is a near certainty.

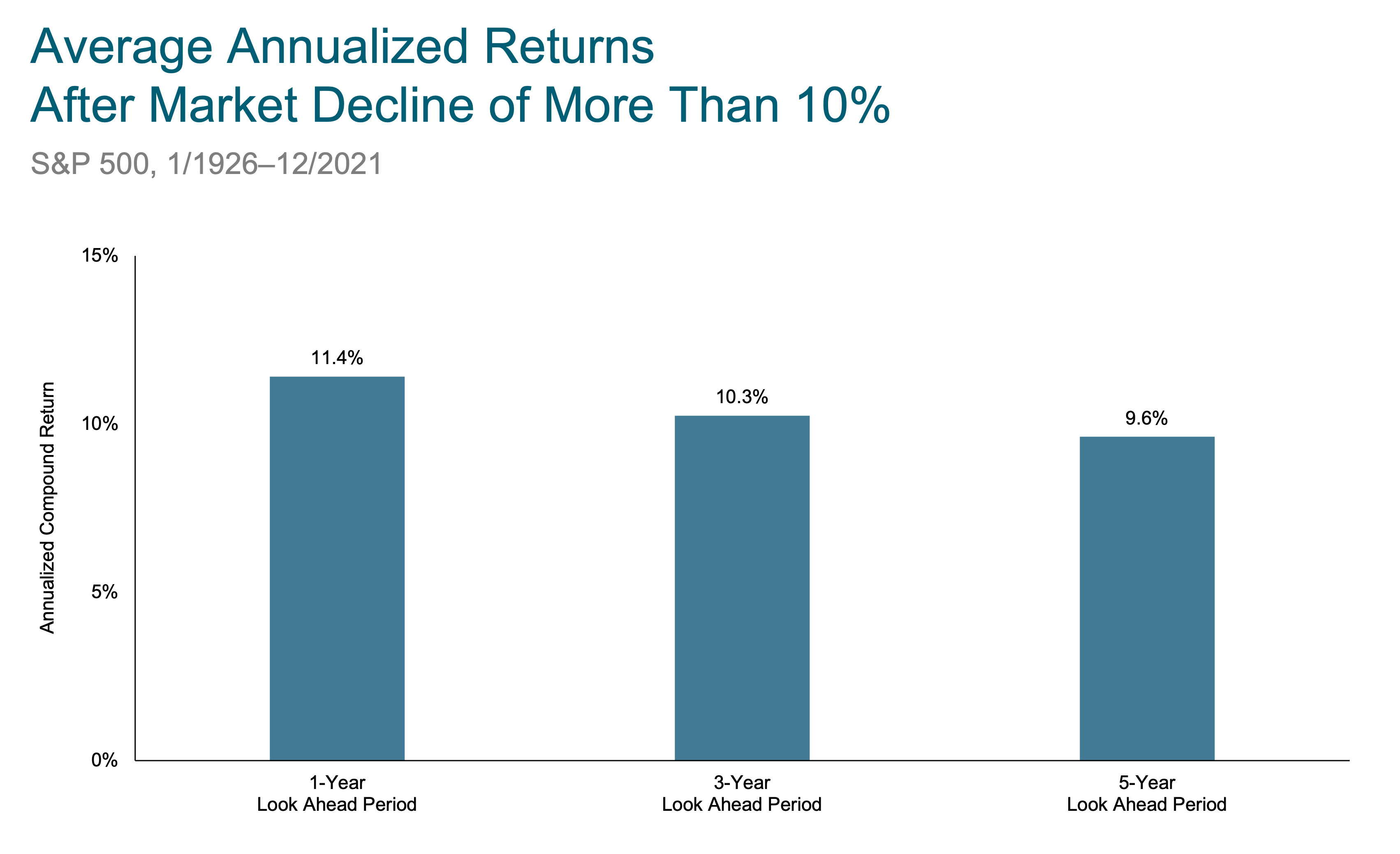

When we use phrases like ‘my stocks are going down’, we assign too much value to this momentum concept. It is a frustrating reality that recent price declines don’t tell us anything useful about what comes next for an individual stock, an industry, or a broad market.

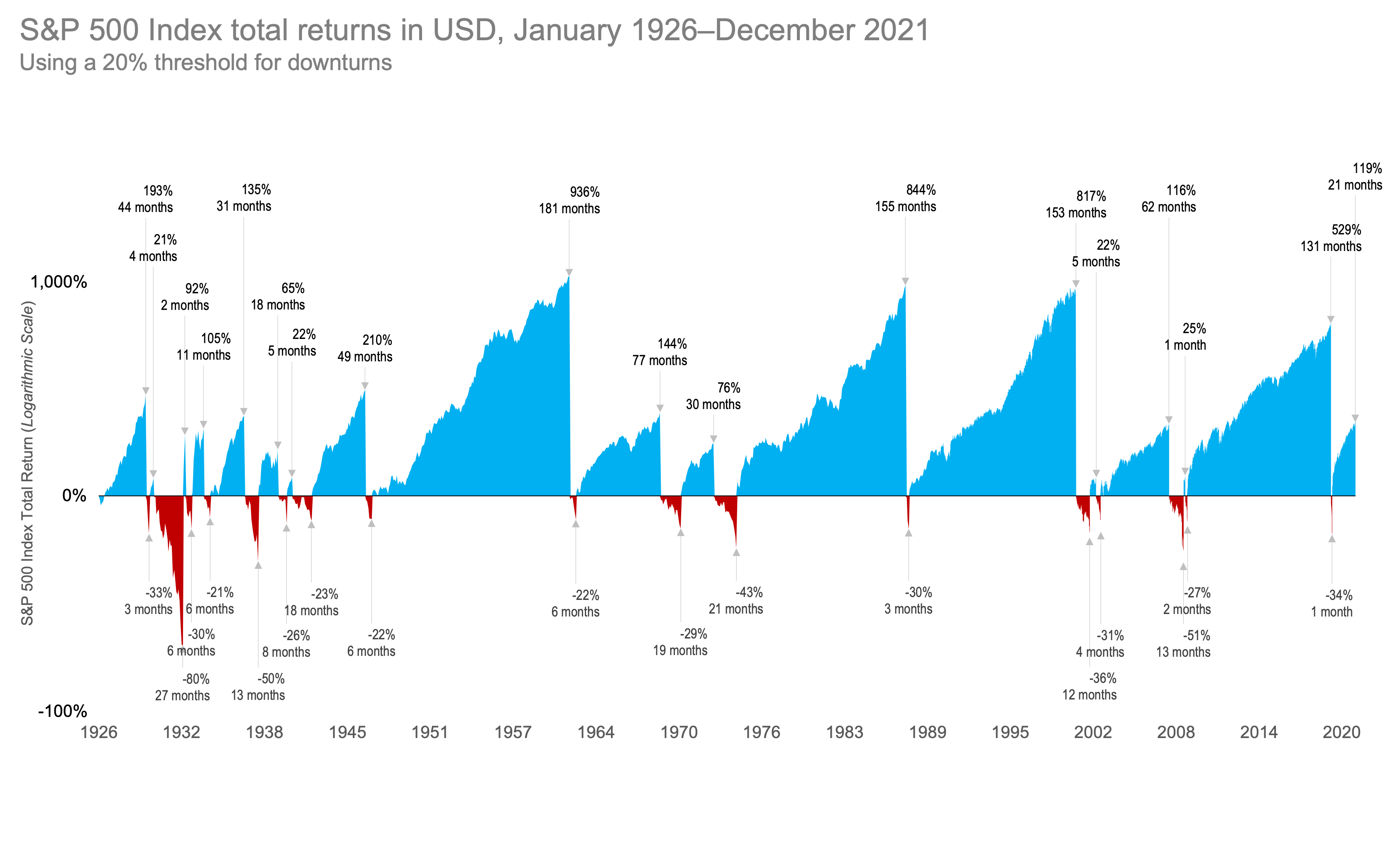

History shows us the ‘bottom’ of extreme market declines of 20% or more have been short lived and the reversal has occurred rapidly. Selling at the wrong time can lead to massive losses of wealth. In the chart below, trying to avoid the red can cost you the blue. This is why it is so important to be clear about distinguishing between what we know about the past, present and future.

If we zoom out from Exxon, I heard plenty of investors and experts stating that demand for oil is ‘in decline’ because of [work-from-home / less travel / clean energy movement / etc]. Those statements lead to overconfidence, which can cause bad investing decisions. Maybe they’ll be right in the long run, but they sure weren’t right in the near term. Simply restating the observation as ‘demand for oil has declined’ opens up the possibility for better decisions. It allows us to consider more possibilities, like complicated geopolitical interdependencies that impact supply.

We use our language to create coherent stories in our minds. In that sense, our words influence our actions. Every time I hear myself saying the markets are ‘going up’ or ‘going down’, I can feel myself implying that I know what comes next. I try to force myself to correct by saying markets ‘have gone up’ or ‘have gone down.’

Return to Blog Page