The Year of the IPO

July 19, 2019 | By Kevin Smith, CFA

Investors revel in the excitement of a beloved tech company ringing the bell on their opening day on the stock market. Months of media attention and speculation about the opening price lead up to this celebrated event. Will this company become the next [Google, Facebook, Netflix]? Will investors make a fortune buying this stock as it shoots out of orbit in the coming months?

2019 has been a big year for IPOs, including consumer services with tens of millions of daily users like Uber, Lyft, Spotify, Snap, and Pinterest, and wildly popular business services Zoom and Slack. There may be more yet to come like WeWork and AirBNB.

US stock prices are at all-time-highs, so valuations are rich, making it a compelling time to sell new shares, and investors seem hungry for the next superstar publicly traded tech companies. With so much venture capital funding available, successful startups are able to stay private longer to increase their value before going public, leaving few opportunities for average investors to participate.

Companies either have privately held stock or publicly traded stock. The major difference is that publicly traded stock can be easily bought and sold by anybody with an investment account. If a company has private stock, shares are owned by employees and investors like angels, venture capitalists, private equity firms and institutions like pensions. When a company ‘goes public’ in an IPO, they are making their stock available to the general public for the first time. They often seek to raise a lot of money by selling new shares in this process, and it gives the previous private shareholders an opportunity to turn their investment into cash.

If you love AirBNB and can’t wait to invest, you will need to wait for their IPO. In reality, the big dogs get one last bite before most of us by participating in pre-IPO shares. To understand the full context and opportunity of an IPO for the average investor, it is important to understand the role of the investment bank that underwrites the IPO. They are hired to help the company ‘go public’. This involves determining how many shares to sell, at what target price, generating interest from investors, and allocating as much of the offering as possible before opening day to ensure success for their client. Most of the ‘pre-IPO’ shares go to institutional and wealthy individual investors who have relationships with the investment bank. The investment bank balances their objectives of a) keeping their clients happy by selling as many shares as possible at a high price, with b) their implicit objective of generating high returns for the investors who buy the shares, which will likely lead to more business in the future. They help set the initial IPO price the day before the opening, the pre-IPO investors buy at that price, which secures proceeds to the company going public. The pre-IPO price is typically less than the expected IPO price to compensate those investors for the risk of the price dropping after the opening bell. (Note: company employees and people who owned share before the IPO, are not allowed to sell their shares for 180 days.)

Between the conflicts of interest in the underwriting process and the difficulty of evaluating a company before its information is publicly available, pre-IPO investors are gambling, but have been rewarded with first-day returns averaging 18% from 1980 to 2018. The companies with higher returns on the first day had a tendency to be more difficult to access in the pre-IPO allocation.

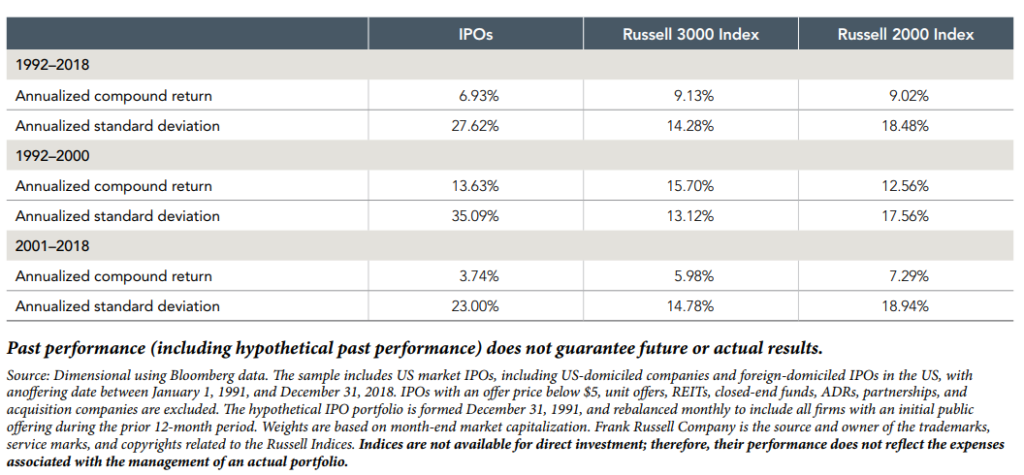

For most investors, the more pertinent question is how have IPOs done AFTER the opening? This is when they can actually buy shares. DFA performed a recent study to evaluate the performance of IPO shares excluding the first day. The results of IPO companies have been sub-par compared to major US market indices (see chart below). The Russell 3000 Index is a list of the 3,000 largest US publicly traded companies. The Russell 2000 index is a list of the smallest 2,000 companies in the Russell 3000 Index. ‘Standard Deviation’ is a measure of how volatile the price has been.

We are beginning to see a trend in the direction of allowing more ‘regular’ investors access to pre-IPO shares, and I expect this to continue. Without access to pre-IPO shares, investors should consider the historical data and resist reacting to the excitement of the event. Your index funds and mutual funds will likely pick up exposure to these companies, which allows you to participate in their performance to a modest degree. Sorry to take the fun out of it!

– Kevin X. Smith, CFA

Return to Blog Page