Using Dollar-Cost Averaging to Reduce Risk

May 15, 2024 | By Kevin Smith, CFA

Investing a large sum of money can be daunting, especially with the uncertainty of market fluctuations. Enter dollar-cost averaging (DCA), a strategy designed to help investors manage risk by spreading their investments over time. By consistently investing a fixed amount, regardless of market conditions, DCA offers several key benefits that can enhance the investment experience.

Key Benefits of Dollar-Cost Averaging:

- Reduce the Risk of Bad Timing: Investing a lump sum can be risky if done right before a market downturn. DCA mitigates this risk by spreading purchases over time, ensuring you don’t invest all your money at an inopportune moment.

- Take Advantage of Falling Market Prices: Regular investments mean you buy more shares when prices are low, potentially increasing your overall returns when the market rebounds.

- Get Invested: For those hesitant to enter the market, DCA provides a structured approach that encourages steady investment without the pressure of timing the market perfectly.

How Does DCA Work?

The DCA strategy involves two key components:

- Regular Investments: You commit to buying a fixed amount of your chosen investment at regular intervals, such as monthly or bi-weekly, until you are fully invested. This approach ensures that you continuously add to your portfolio, regardless of market conditions.

- Buying More During Dips: In addition to regular investments, you plan to invest more when the market experiences significant declines. This helps you capitalize on lower prices and potentially increase your returns when the market recovers.

Choosing the Right DCA Model:

There are various DCA models to suit different investment goals and market outlooks. Part of our job as advisors is to match a suitable DCA model with your situation:

- Standard DCA: This model spreads your investments over a moderate timeframe (e.g., 6 months), balancing between avoiding market peaks and getting fully invested.

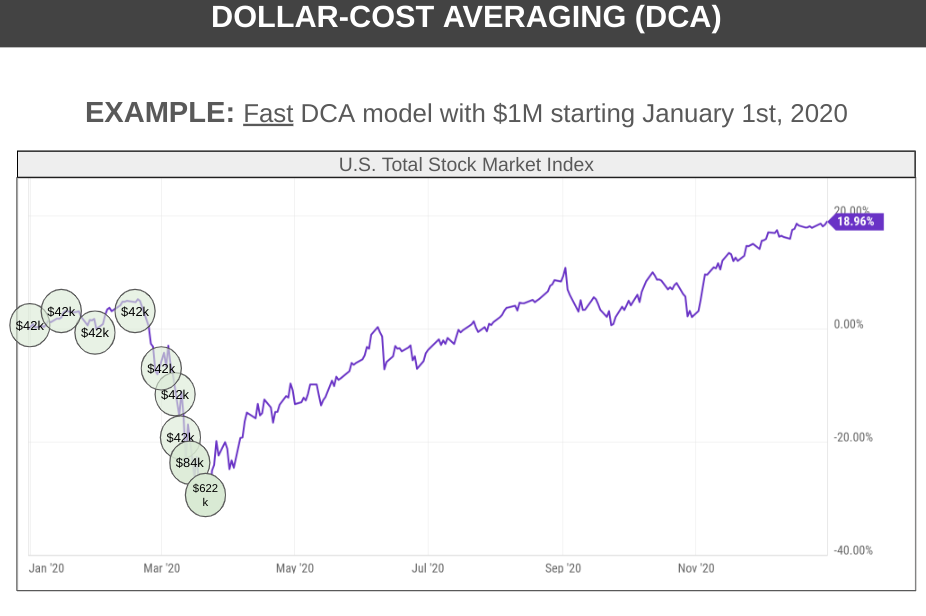

- Fast DCA: Ideal for those who want to invest quickly, this model compresses the investment period (e.g., 3 months). It is suitable if you expect a market downturn in the near term or are eager to get your cash in quickly.

- Slow DCA: For a more cautious approach, this model extends the investment period (e.g., 12 months), reducing the risk of buying at high prices, but it requires patience as you wait to be fully invested.

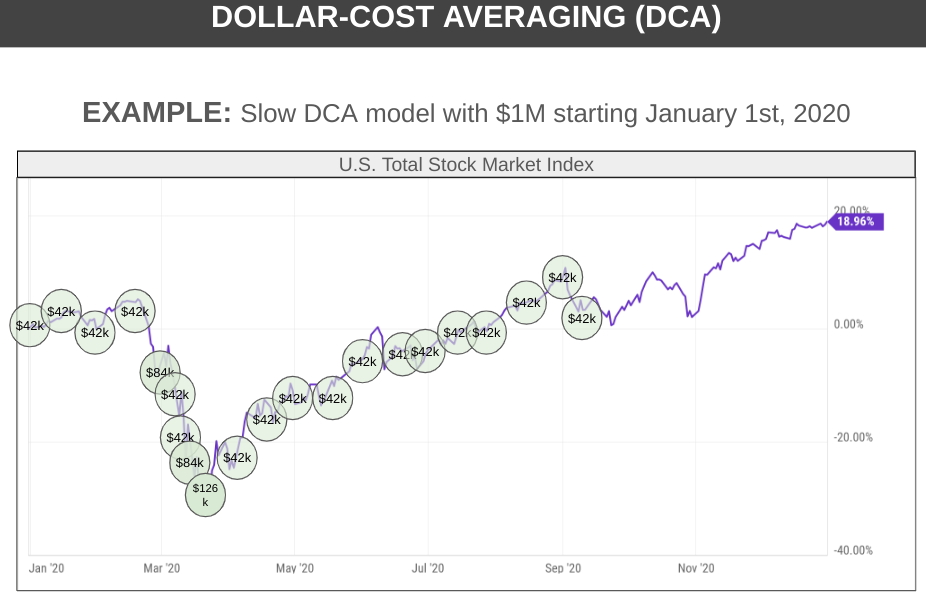

Example of DCA in Action: Consider a $1 million investment starting in January 2020. Using our slow DCA model, you would invest a set amount (e.g., $42,000) every two weeks, adjusting to invest more during significant market dips. This structured approach helps manage market volatility, allowing you to potentially benefit from lower prices during downturns and participate in market recoveries.

In contrast, here is that same starting amount of $1 million, but using our “fast” DCA schedule:

By committing to regular investments and strategically increasing your contributions during market declines, DCA can be a helpful strategy to build a robust portfolio without the stress of trying to gauge uncertainties or time the market.

Return to Blog Page