Year-End Planning Tips: Roth Conversions

October 24, 2018 | By Kevin Smith, CFA

The Roth IRA is fantastic. When you deposit funds to a Roth IRA, the IRS tells us that you will never be taxed again on that money. This can be particularly compelling if you are expecting significant taxable income in your retirement years. For example, if you expect to have a $2M 401k balance at age 71, your required minimum distribution would be about $75,000. If you combine that taxable income with social security and other investment income, you could likely find yourself in a high tax bracket. Converting funds from your IRA to a Roth IRA will reduce the size of the required taxable distribution.

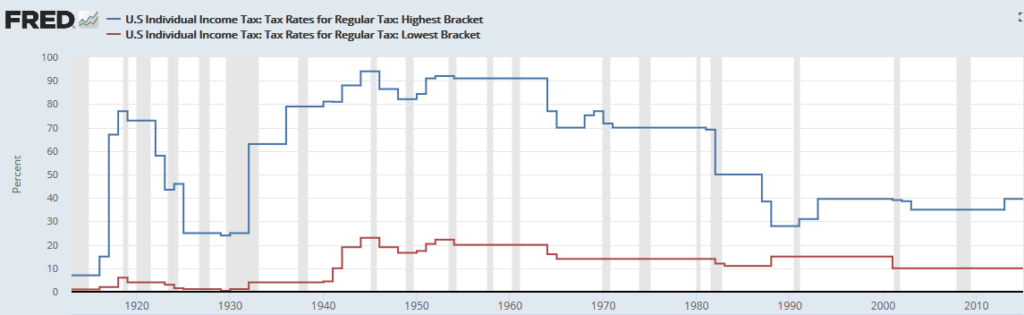

The fact that marginal tax brackets were recently lowered by the Trump administration makes the Roth Conversion even more compelling. The strategy wins if the taxes you pay at conversion are lower than the income taxes when you eventually take the money out. Given that tax brackets are historically low and the federal debt is about $21,672,453,590,238 – odds are that tax brackets will increase in the future. In fact the recent tax cuts will expire in 2025. The chart below shows the history of the top marginal tax bracket in blue and the lowest bracket in red. These Federal Reserve figures have not yet been updated with the recent changes, but you can see the massive difference since the Reagan era.

This strategy works best if you find yourself in an abnormally low income tax year, which allows you to pay income taxes on the conversion in a low tax bracket. Let’s pretend you just retired and you are living off of your non-401k investments, so your taxable income will only be $20,000. In 2018, you will only pay 12% taxation on a Roth Conversion until your taxable income reaches $77,401. This means you could convert $57,401 at 12% taxation. My guess is you were in a much higher tax bracket when you were working and made the pre-tax 401k contribution.

- This could also work if you have lower than normal income because you are are between jobs or starting a business and taking less income.

- Roth Conversions must be done by December 31st, 2018 to count on your 2018 tax return.

- An added bonus of the Roth IRA is that it is inherited tax-free.

- Note that Roth 401k conversions are possible while you are working, but not all 401k providers allow it.

Return to Blog Page