Year-End Planning Tips: Your Charitable Fund

October 24, 2018 | By Kevin Smith, CFA

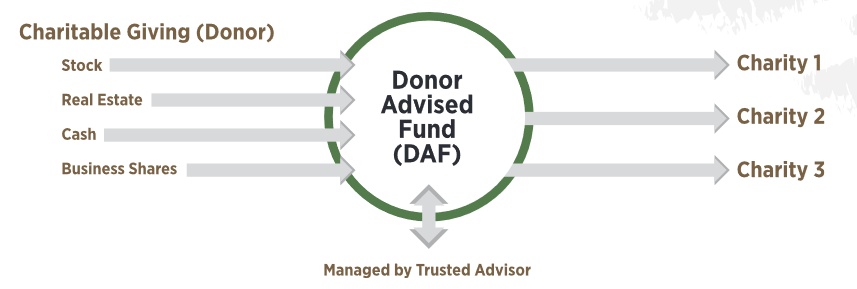

A Donor Advised Fund (DAF) is kind of like your own personal endowment, but without the administrative costs and hassles. A DAF is an investment account that receives your charitable donations, allows you to take the tax deduction in the year of the contribution, invest the funds so they can grow, and take your time to decide which charities you would like to fund.

If you are interested in setting up a Donor Advised Fund, please take action soon. The application deadline is December 14th and contributions must be made by year-end. The minimum contribution is $10,000.

Image from American Endowment Foundation https://www.aefonline.org/

Posted in: Uncategorized

Return to Blog Page