Inflation and Your Cash Flow

November 15, 2022 | By Kevin Smith, CFA

The combination of high price inflation, higher interest rates, and a stock market recession is rippling through household budgets across the world. The impact varies quite a bit depending on sources of income, debt levels, property ownership, insurance coverage and lifestyle habits, but the bottom line is cash flow in 2022 has been under pressure.

Many of our younger clients with school-aged kids have compensation plans tied to depressed company stock prices, and bonuses tied to strained corporate budgets. Income and expenses have gone in the wrong directions, which will drain bank accounts and cause a liquidity crunch without proper budget adjustments.

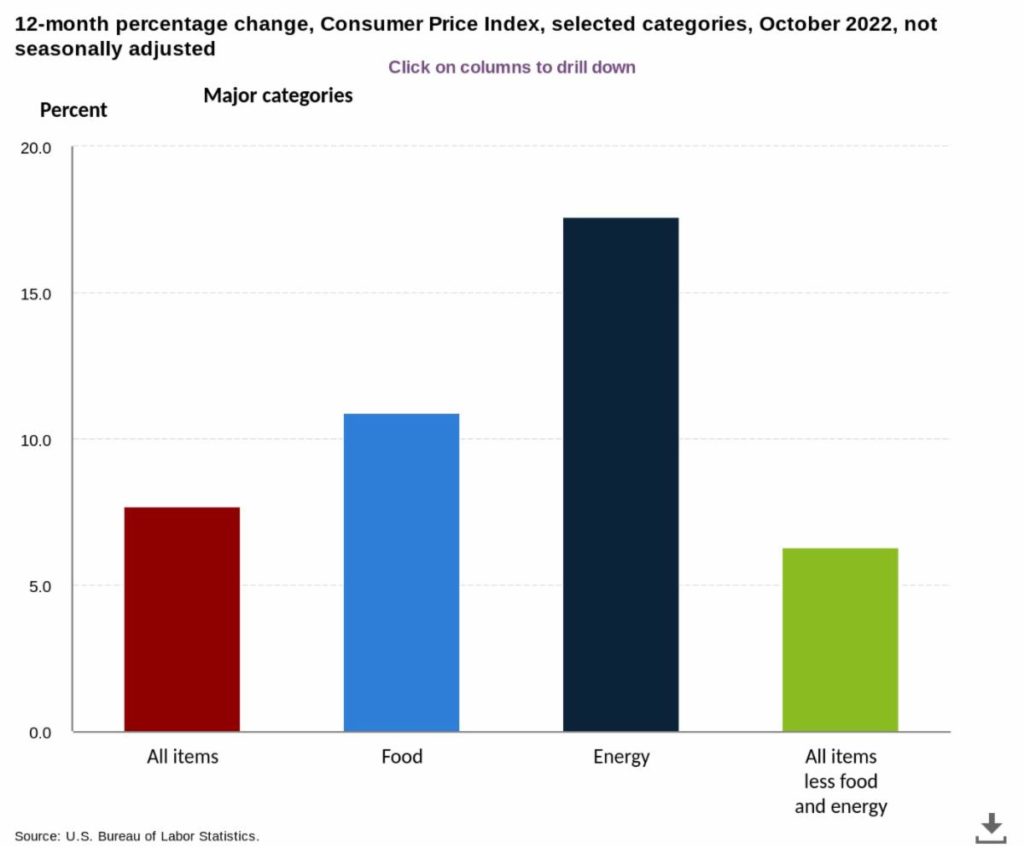

Retired folks have seen their stocks and bonds fall at the same time, while the cost of travel is way up. But there are some silver linings for them. Interest rates are finally high enough to generate meaning income on low risk assets, and Social Security income will increase by more than 8% next year. Paid-off mortgages and frozen property taxes give them more stability during high inflation. The main sources of budget stress have been in food and energy prices, which can be managed, to an extent.

To help put all of this in perspective, we created a comparison of cash flow budgets from 2021 to 2022 for a household of young working professionals with kids and common financial obligations. It is meant to help put the real-life impacts of the economic climate in perspective.

Here is a link to the full side-by-side analysis, and see below for some highlights, by category:

Income

- Salaries: +5% on average across the U.S.

- Bonuses: many are much lower than last year

- Company Stock: many are down 20-50%

Taxes

- Income tax: no meaningful changes

- Property tax: +10% for lots of areas in Texas

Home Expenses

- Mortgage: no change for fixed rates

- HELOC: possible 20% payment increase

- Utilities: +15%

- Home Services & Maintenance: +7-8%

Insurance

- Medical:+1%

- Auto: +7%

- Homeowners: +12%

- Term Life: 0%

Kids’ Daycare/Tuition/Activities: varies +3-5%

Food/Shopping/Etc Spending: 7-10%

This model household went from saving 16% of gross income in 2021 to 5% in 2022, without making any changes to their spending habits. That leaves very little room for unexpected or spontaneous expenses. As advisors, one of the most important things we can do with families is help them make practical cash flow improvements.

For a similar analysis of a retired household, see the full report here.

Return to Blog Page